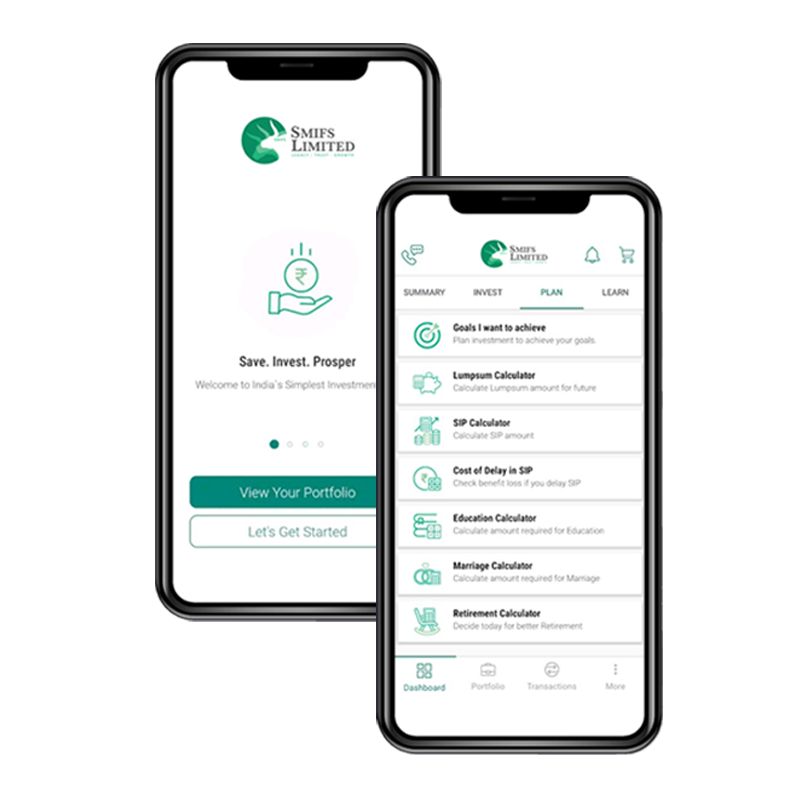

COMMODITY DERIVATIVE TRADING

SMIFS Limited is a member of both the exchanges Multi Commodity Exchange of India (MCX) and National Commodity and Derivatives Exchange (NCDEX) which caters to commodity trading in India and commodity broking services to niche clients, corporate and HNI’s and commenced activities in commodity derivatives in 2012. We are a strong proponent of research based decision making for investments and trading. Our Commodity sales and dealers are trained in commodity derivatives to help and serve the Clients in the commodities market by providing a robust support system.