A lot of people assume that Non-Resident Indians (NRI) are either not allowed to invest or face a lack of diversity when it comes to investment options in India. This is not true and there exists a lot of investment options and opportunities provided that the guidelines and regulations set by the Reserve Bank of India (RBI), the Securities and Exchange Board of India (SEBI), and the Foreign Exchange Management Act (FEMA) are adhered to.

As one of the fastest-growing major economies in the world, India’s market is lucrative and promising for NRIs looking to build a diversified portfolio with the amount of investment choices available.

There are two terms to categorise Indian people living overseas. Non-Resident Indians (NRI) are citizens of India residing abroad while Persons of Indian Origin (PIO) refers to citizens of another country with Indian ancestry or birth.

|

KEY TAKEAWAYS

|

What Impact do NRIs have on the Indian Economy?

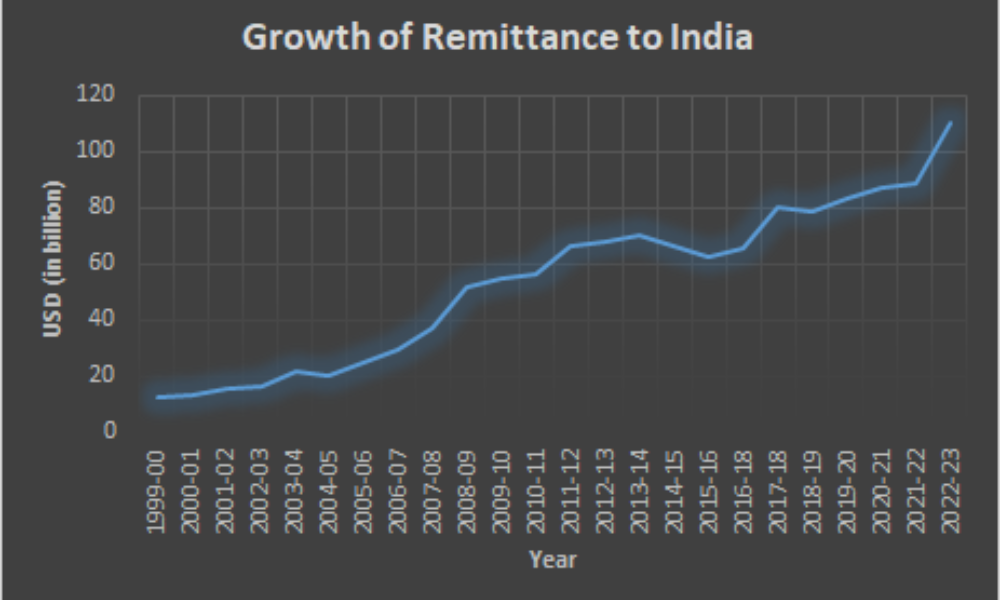

NRIs remitting money back to India contributes a significant amount to the country’s Foreign Exchange Reserves and is an important source of foreign currency inflow for India. NRIs can invest in India under the Foreign Exchange Management Act of 1999. The statute has been modified from time to time to bring new investments under the broader umbrella relating to NRI investments. Mutual funds, Stocks, Term Deposits, and Real Estate are some of the options available to NRIs. The expanding and growing market provides more opportunities for NRIs to invest, thus increasing foreign remittances.

Remittances can contribute to the stimulation and growth of the economy as the recipients spend the money locally by buying goods or supporting a business.

Reduction of poverty, albeit on a smaller scale, can be attributed to the huge diaspora of NRIs from an impoverished background remitting money back which helps alleviate the economic conditions of their respective families.

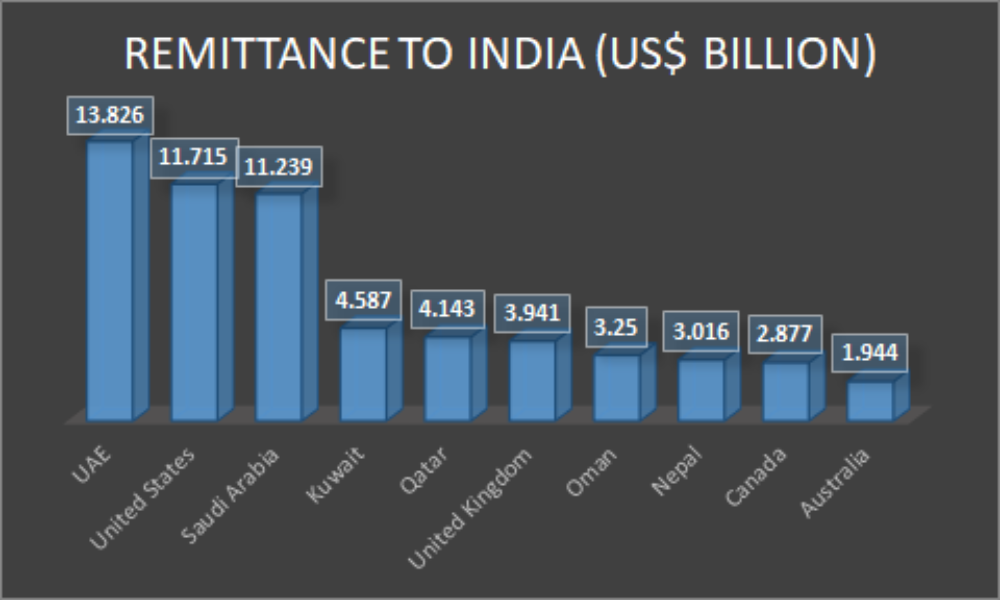

In recent years, the sources of remittance have seen a gradual shift from being dominated by the largely low-skilled and informally employed NRIs in the Gulf and Middle-Eastern countries to now being balanced by remittances from high-skilled jobs in developed countries such as the US, UK, Australia, Canada, and New Zealand.

Eligibility Criteria for NRI Status

There are different rules and taxation laws pertaining to NRIs and as such it is important to know about the procedure and documents required before investing.

As per the Income Tax Act, the eligibility criteria for NRI status are as follows:

- An Indian citizen staying abroad for 183 days or more in one financial year.

- An Indian citizen who has stayed in India for less than 365 days in the last four years from the current assessment year and less than 60 days during the year.

Procuring an investment as an NRI in India requires a Bank Account, along with compliance with KYC mandates which includes documents of Address Proof, Bank Statement, PAN card, and Passport Copy. They also need a basic PINS (Portfolio Investment Scheme) Account to buy shares from the secondary market. SEBI regulations dictate that for NRIs as well, it’s mandatory to hold NRI Demat accounts to trade in the Stock markets of India. Click here to view the required documents for an NRI Demat Account.

Types of Bank Accounts Available to NRIs:

The two major types of NRI Accounts available to an NRI Investor:

- NRE (Non-Resident External) Savings Account/Fixed Deposit Account:

NRE Accounts can be used to deposit foreign earnings and are exempt from tax. Neither the balance nor the interest earned on these accounts is taxable.

- NRO (Non-Resident Ordinary) Savings Account/Fixed Deposit Account:

NRO Accounts are to be used to manage income and expenditures done in India and as such are taxable at 30% of the total income accrued in India, as per the Income Tax Act of 1961.

It is also important to know about the Double Tax Avoidance Agreement (DTAA) between India and the NRI’s country of residence. Depending on the country, different taxation laws and rates might be followed.

Why Invest in India?

As one of the fastest-growing major economies in the world, India has experienced significant economic growth over the past few decades and is expected to continue growing in the long term.

Along with a fast-growing market, India offers a wide range of investment options which include Equities, Fixed-Income Assets, Commodities, and Mutual Funds, among others. The minimum requirements for investment, depending upon the asset class, are lower than in many other countries, making it easier for NRIs to invest.

Even though the political landscape can prove to be complex as regulatory changes can or may have an impact on investments, the overall political and regulatory climate has been stable resulting in an increase in the inflow of Foreign Direct Investment (FDI). It is still essential to stay informed and updated on government policies and regulations that might affect your investments.

With only 3% of the country’s mainland population participating and investing in the Stock Market actively, it is no surprise that the majority of NRI investment in India is still done in Fixed-Deposits (FD) and Real Estate, owing to the prevailing sentiment of it being a ‘safe investment’ coupled with a lack of understanding or risk-taking ability to earn higher returns through other investment options.

What are the Most Popular NRI Investment Options?

When it comes to the Indian Capital Market, there are certain limitations on the activities that can be carried out by an NRI when it comes to investments. NRIs are barred from carrying out Intra-day transactions in the Cash Segment nor are they permitted to Short-Sell, along with not being able to participate in the Currency Derivatives Trading Market via their NRI Demat account.

Nevertheless, NRIs have several options to choose from when it comes to investments for the purposes of creating a diversified portfolio and wealth creation. Guidelines laid out by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) must be followed while making such investments.

-

Equity Investments:

NRIs can participate and invest in the Indian Stock Markets through the Portfolio Investment Scheme (PIS), enabling them to purchase or sell shares of Indian companies, and invest in Futures and Options (F&O) trading through an accepted Stock Exchange. Such trades can be executed on a non-repatriation basis only and are subject to RBI regulatory limits.

The Portfolio Investment Scheme (PIS) is a scheme of the Reserve Bank of India (RBI) that permits NRIs to purchase and sell shares or debentures of Indian companies on any recognized Stock Exchange by routing the transactions through their NRI Bank Account with a designated bank branch.

Transactions in the secondary market have two types of requirements based on whether they are on a repatriable (NRE Savings Account) or a non-repatriable basis (NRO Savings Account).

-

Mutual Funds:

The Mutual Fund industry has seen significant growth amounting to a six-fold increase in just 10 years. The Assets Under Management (AUM) of the industry has grown from ₹7.46 trillion in 2013 to ₹46.58 trillion in 2023. This makes it an attractive option for NRIs looking to invest in something less volatile than the Equity Market.

-

Bonds and Fixed-Deposits (FD):

Fixed Deposits will always remain a popular investment choice for NRIs due to their low risk and almost assured fixed returns.

Bonds represent debt instruments issued by entities while Fixed Deposits are where you deposit money with Financial Institutions for a fixed term period.

There are three main bond categories:

-

- PSU Bonds – Public Sector Undertaking Bonds (PSU Bonds) are bonds in which the government owns more than 51% of the company. It is a medium and long-term debt instrument issued by Public Sector Companies.

- Non-Convertible Debentures (NCD) – The creditworthiness of the corporation issuing the PSU will influence the interest rate. These investments are taxed at 20% if you sell it after owning it for more than 3 years.

- Perpetual Bonds – These Bonds have no maturity date and as such there is no fixed date on which they pay out. The issuing company, however, pledges to pay the holder of the bond a fixed amount of returns each year. These types of Bonds are traded on the open market and thus it is up to the market conditions and Investor sentiment and analysis to turn a profit on the sale of Perpetual Bonds.

NRIs can open a Fixed Deposit through their NRO or NRE accounts registered with a bank in India. FDs available to NRIs offer competitive interest rates over the range of 1-10 years depending on the type of deposit. A premature withdrawal, subject to certain regulations and penalties, is also permitted.

-

National Pension Scheme (NPS):

NPS is a voluntary, long-term savings scheme introduced in India in 2004 that has gained popularity as an investment option for retirement planning. The regulatory body is the Pension Fund Regulatory and Development Authority (PFRDA).

The scheme is designed for people to invest in the account at regular intervals during the period of their employment up until their retirement. After retirement, account holders can take out a certain percentage of the holdings, while the remaining amount will be received as a monthly pension post-retirement.

Summary

In a globalised and digitally connected world, NRIs are now more connected to India than ever before which allows them to explore the opportunities and investment options available in a much easier and transparent way.

Strong ties to India and a desire to support and contribute to the home country are also significant attributes of the Indian diaspora which help drive the investments and increase the inflow of foreign capital.

The Indian Government, along with the Financial Institutions are still on the continuous path of taking steps and introducing policies to provide a transparent framework and offering competitive investment options to promote an environment that is conducive to attracting and retaining NRI investments.

The country’s growth potential and favourable market conditions along with constant improvements to provide safety and transparency have certainly placed it as a lucrative investment destination, resulting in the trend pointing towards a continued growth in investments done by NRIs in India.

Frequently Asked Questions

Q: Can NRIs invest in India with only their PAN card?

A: Mutual Funds and other asset classes can require a PAN Card and an NRE/NRO Account. However, the documents required differ as per the asset class.

Q: What funds can an NRI invest in?

A: Among the many options, some of the most popular choices are Mutual Funds, Bonds (and NCDs as well), National Pension Scheme (NPS), Fixed Deposits (FD), Public Provident Fund (PPF), Equity Shares and Real Estate.

Q: What is a Portfolio Investment Scheme (PIS)?

A: The Portfolio Investment Scheme (PIS) is a scheme of the Reserve Bank of India (RBI) that permits NRIs to purchase and sell shares or debentures of Indian companies on any recognized Stock Exchange by routing the transactions through their NRI Bank Account with a designated bank branch.

Q: What documents are required to open an NRI Demat Account?

A: Click here to view the documents required.

Q: Can NRI place an Intraday Order?

A: No. NRIs are barred from Intraday Transactions and Short-Selling.

Q: Can NRIs trade in the Currency Derivative Segment of the Exchange?

A: No. As per the rules and guidelines set by RBI and SEBI, NRIs are not allowed to trade in the Currency Derivative Segment.