Celebrating Independence Beyond 15th August

Independence Day is more than a date in the calendar; it’s a powerful reminder of the value of freedom — in every sense of the word. At SMIFS Limited, we believe the ideals behind this day extend beyond political liberty to personal and financial independence. This is where Independence Day financial planning comes into play.

When we talk about Independence Day financial planning, we are talking about giving yourself the freedom to make choices without being restricted by financial constraints. Just as the nation fought for its right to self-govern, each individual should strive to gain control over their financial destiny.

This 15th August is not only a celebration of our shared past but also an opportunity to shape our personal future. By starting your Independence Day financial planning journey now, you take the first step toward a life where money is a tool for empowerment rather than a source of stress.

The Cost of Our Independence

The Cost of Our Independence

From 1857 to 1947, India’s freedom struggle came at a profound human cost. Major events like the Revolt of 1857, the Jallianwala Bagh massacre (1919), and the Quit India Movement (1942) alone claimed tens of thousands of lives. Historians estimate over 50,000–60,000 Indians died directly in uprisings, police firings, prison executions, and other acts of resistance. When including famine deaths, forced labor, and casualties from repressive colonial policies tied to the struggle, the toll rises to several hundred thousand — a stark reminder that independence was earned through unimaginable sacrifice.

This legacy of sacrifice inspires us to value the freedoms we enjoy today — including the opportunity to work toward financial self-reliance through thoughtful Independence Day financial planning.

Why Financial Freedom Matters

Financial freedom isn’t simply about having wealth — it’s about having the power to make decisions without fear or compromise. Independence Day financial planning equips you with the strategies and safeguards to achieve that.

Without a plan, financial stress can limit your choices and overshadow your ambitions. With the right Independence Day financial planning approach, you can:

-

Secure Your Lifestyle: Ensure you and your family maintain a stable quality of life, no matter the circumstances.

-

Pursue Your Dreams: Whether it’s starting a business or traveling the world, financial freedom enables you to focus on your passions.

-

Be Prepared for Emergencies: With solid Independence Day financial planning, unexpected medical bills, job loss, or market downturns won’t derail your future.

-

Retire Comfortably: Plan for a retirement where you can live life on your terms without financial worry.

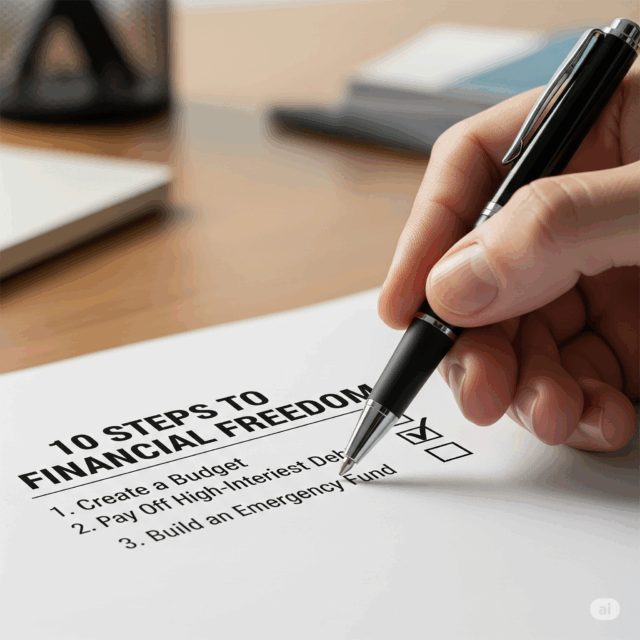

Path to Financial Freedom

Financial independence is not about sudden wealth or chasing the latest market trend. It is a structured process that demands clarity, discipline, and long-term commitment. A well-planned approach, such as Independence Day financial planning, ensures that you can achieve your goals without compromising your lifestyle or peace of mind. Below is a step-by-step roadmap to help you work towards financial freedom in a sustainable way.

1. Set Clear Financial Goals

The first step toward financial freedom, and a crucial part of Independence Day financial planning, is identifying what you want to achieve. Goals provide direction and help you measure progress. Start by defining both short-term and long-term objectives. Short-term goals could include creating an emergency fund, clearing high-interest debt, or saving for a holiday. Long-term goals may involve building a retirement corpus, purchasing property, or funding your children’s higher education.

When setting goals, make them SMART, which means Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of saying “I want to save more,” set a goal such as “I will save ₹50,000 in the next 6 months by reducing unnecessary expenses and automating savings.” Integrating such structured objectives is the heart of Independence Day financial planning.

2. Build an Emergency Fund

An emergency fund is a vital safety net in Independence Day financial planning. It ensures you have access to money in case of unexpected events such as medical emergencies, job loss, or urgent repairs. Experts recommend keeping 6–8 months’ worth of essential expenses in a liquid and easily accessible account, such as a savings account or a liquid mutual fund.

This fund is not meant for discretionary spending. It should be used only during genuine emergencies. Having this buffer helps you avoid taking high-interest loans or liquidating long-term investments prematurely. A robust emergency fund is the backbone of Independence Day financial planning.

3. Manage Debt Wisely

Debt, if not managed properly, can derail your Independence Day financial planning journey. High-interest loans such as credit card balances and personal loans should be paid off quickly. Make a debt repayment plan by listing all your outstanding loans, noting their interest rates, and prioritising repayment of the highest-interest debt first.

If possible, consolidate your debts into a single, lower-interest loan to make repayment more manageable. Once high-interest debt is under control, you can channel more funds toward investments, which is a key aim of Independence Day financial planning.

4. Create a Budget and Stick to It

A budget is a powerful tool in Independence Day financial planning. By tracking income, expenses, and savings, you can identify unnecessary spending and redirect those funds toward your financial goals. A common rule is the 50/30/20 approach, where you allocate 50% of income to needs, 30% to wants, and 20% to savings and debt repayment.

Review your budget regularly, especially if your income or expenses change. Consistency in budgeting forms the foundation for successful Independence Day financial planning.

5. Start Investing Early

Time is one of the most powerful tools in wealth creation, making early investment a core principle of Independence Day financial planning. Even small, consistent investments can grow substantially over time through compounding.

Consider a mix of asset classes such as equities, mutual funds, fixed deposits, bonds, and gold. The right combination depends on your risk appetite, investment horizon, and goals. Systematic Investment Plans (SIPs) are an effective way to stay disciplined, and this habit is central to Independence Day financial planning.

6. Diversify Your Portfolio

Diversification is essential to reduce risk, and it is a golden rule in Independence Day financial planning. Spread your investments across asset classes, sectors, and geographies so poor performance in one area does not derail your wealth-building efforts.

A balanced portfolio might include equities for growth, fixed income for stability, and gold for inflation protection. Regular reviews ensure your Independence Day financial planning remains aligned with your goals.

7. Protect Yourself with Insurance

Insurance is a critical safeguard in Independence Day financial planning. Life insurance secures your family’s future, term insurance is cost-effective, and health insurance shields you from medical expenses.

Even if you have employer-provided coverage, an additional policy can add security. Asset insurance for your home, vehicle, or business protects against unforeseen losses and reinforces your Independence Day financial planning strategy.

8. Plan for Retirement Early

Retirement planning is an inseparable part of Independence Day financial planning. Starting early allows your corpus to grow steadily without straining your current finances. Estimate future expenses, factor in inflation, and calculate the amount you will need to retire comfortably.

Use provident funds, retirement-specific products, and equity exposure to create a portfolio that supports your independence well into old age. This is the essence of Independence Day financial planning.

9. Review and Adjust Regularly

Your Independence Day financial planning is not static. Life events like marriage, career shifts, or the birth of a child require adjustments. Review your finances annually to ensure your goals, asset allocation, and investment performance are still on track.

Making timely adjustments keeps your Independence Day financial planning relevant and effective over the long term.

10. Seek Professional Guidance

While self-education is powerful, professional advice can refine your Independence Day financial planning. At SMIFS Limited, we offer personalised, SEBI-compliant strategies tailored to your needs, ensuring every aspect of your Independence Day financial planning aligns with your vision of financial freedom.

With our expertise, you can focus on living your life while knowing your financial future is in expert hands. This Independence Day, let your Independence Day financial planning be the foundation for true freedom, both national and personal.

SMIFS’ Role in Your Financial Independence

At SMIFS Limited, we believe independence is more than just a date on the calendar — it’s a way of life. True freedom comes when you have the financial stability and confidence to make decisions that align with your dreams, without fear or limitation.

With over three decades of experience as a SEBI-registered financial services provider, we combine expert market insights, robust research, and personalised advisory to help our clients achieve their unique financial goals. Whether you’re planning for retirement, investing for growth, or safeguarding your wealth for future generations, our team offers end-to-end solutions tailored to your needs.

From portfolio management and investment advisory to research-driven recommendations, we ensure every strategy is rooted in integrity, transparency, and your best

Bottom-Line

This Independence Day, as we honour the sacrifices that gave us freedom, let’s also commit to building a future where financial independence is not just an aspiration but a reality for all.

At SMIFS Limited, we stand ready to guide you every step of the way. Because when you achieve financial freedom, you gain the power to live life on your terms — and that is the truest form of independence.

The Cost of Our Independence

The Cost of Our Independence