Learning from the experts is one of the best ways to advance swiftly when you are learning how to invest. It is preferable to obtain the expertise and knowledge of the professionals rather than repeating the same old mistakes made by new investors. By choosing wisely and avoiding foolish investments, you may save thousands of rupees.

Here are the top seven investment books of all time. They have stood the test of time and still educate new readers by imparting the knowledge of seasoned investors.

1. An Intelligent Investor by Benjamin Graham

A well-regarded book on value investing is Benjamin Graham’s The Intelligent Investor, which was first released in 1949. The book offers advice on how to use value investing in the stock market successfully. The book has historically been one of the most appreciated investment books, read by almost every investor.

Value investing is the primary investment strategy that Graham outlines in The Intelligent Investor. Value investing is an investment technique that looks for inexpensive stocks of businesses with the potential to perform well over the long term. Value investing is unconcerned with stock price fluctuations or short-term market trends. This is due to the belief that the market overreacts to price movements in the near term without considering a company’s fundamentals for long-term growth. The foundation of value investing is the idea that, if you know a stock’s true value, you may save a lot of money by purchasing it while it is on sale.

Graham, in the book, creates a figure named Mr. Market, a metaphor for the schizophrenic stock market, which sells stocks for low prices one day and high prices the next day. This book has been published numerous times, but the more recent iterations with editor Jason Zweig add contemporary commentary that offers perspective on recent events.

2. The Psychology of Money by Morgan Housel

This light read takes the reader through 19 chapters that explain the behavioural psychology surrounding money and the often strange ways that individuals think about money as a whole.

Morgan Housel teaches you how to develop a better relationship with money and thus make wiser financial decisions. He doesn’t pretend that people are ROI-optimizing machines; instead, he demonstrates how your psychology can both help you as well as hurt you. Morgan in the book, suggests we stay wealthy instead of getting wealthy.

For instance, to demonstrate his point, he used the life and career of Warren Buffett, chairman, and CEO of Berkshire Hathaway, who infamously shuns the trappings of modern prosperity and has invested since he was a little child.

3. The Ultimate Day Trader by Robert Bernstein

Robert Bernstein, author of the book has written 35 books on trading, investor psychology, economic forecasting, etc. He is also the founder of Bernstein Investment Inc. (a money-management firm).

After explaining that day trade is for experienced investors, the book’s first chapter “Definitions and Directions—What It Means to Day Trade Today” provides a comprehensive guide for beginners and experienced investors who wish to learn more about the subject (i.e. day trading).

According to him, “A day trader is an individual who enters and exits a position in the markets during the course of the trading day”.

There are 11 reasons to day trade, according to Bernstein, including lower headline risk, knowing the results at the end of the “day,” access to accurate forecasting, the potential for quick execution, market volatility, and the simple enjoyment of doing it. Day trading is particularly time-consuming, competitive, stressful, and prone to random events that affect prices, which are the drawbacks, albeit they may not be disadvantages to everyone.

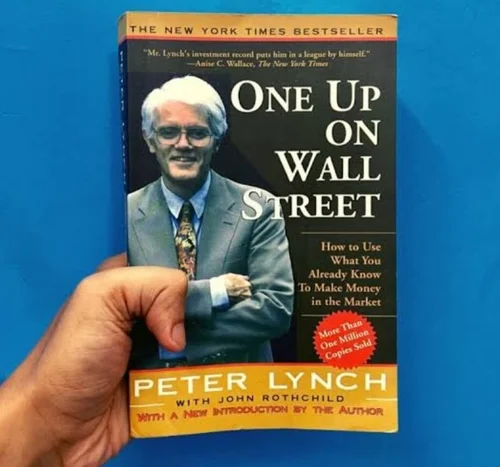

4. One Up on Wall Street by Peter Lynch

This seminal book on investing, written by the renowned mutual fund manager Peter Lynch, has sold over a million copies. The book outlines the advantages that regular investors have over specialists, and how they can use these advantages to succeed financially.

Lynch asserts that there are prospects for investing everywhere. We interact with products and services all day long, whether at the grocery store or the office. We can identify firms to invest in before professional analysts do by focusing on the best ones. Early investors sometimes discover “tenbaggers,” or stocks that increase ten times their initial investment. An average stock portfolio can do admirably with a few tenbagger stocks.

According to Lynch, your portfolio might profit you if you invest in the long run. One Up on Wall Street is a #1 best-seller and a reference work for financial knowledge due to its ageless wisdom.

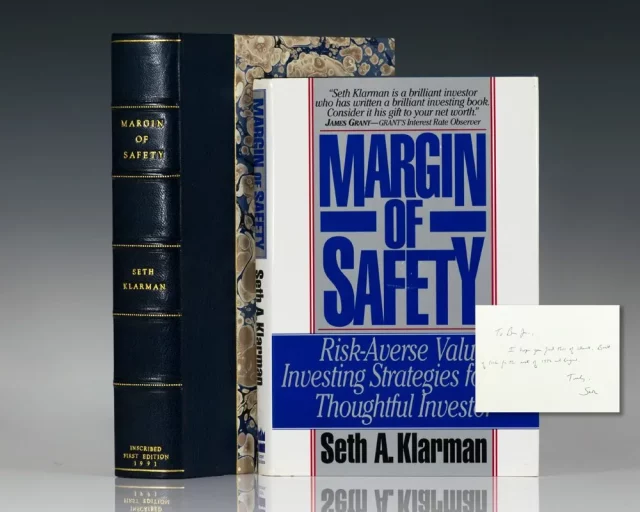

5. Margin of Safety by Seth Klarman

Seth Klarman’s Margin of Safety is regarded as a classic among investment literature. The book came out in 1991 by multi-billionaire Klarman, and ever since it has been regarded as the holy grail. This is due to the book’s scarcity. It has never been reprinted, and vendors commonly charge more than $1,000 for each copy.

The book describes Klarman’s cautious, value-based investing strategy, which employs the margin of safety. In other words, he recommends you purchase an item at a sufficiently cheap price compared to its likely value, so that it would be difficult to experience a loss.

In the book, Klarman mentions how every investor’s top priority should be preventing losses. According to the book, investing with a big margin of safety is the best method to prevent loss, as valuation is a subjective art, and the future is unpredictable.

6. Stocks to Riches by Parag Parikh

Not many Indian authors have produced such a well-written account of the Indian stock market as Parag Parikh has in this fascinating and captivating book called Stocks to Riches.

The chapters’ contents match the excitement of their respective titles. As a reputable broker, Parag Parikh has clarified and simplified all the best methods for making investments in the Indian stock market.

This book provides answers to issues like why certain stock market investors’ careers last such little time, and what trading errors are so prevalent but so challenging to avoid.

The work presents vital viewpoints that may be used by an outsider to enter the stock market globe because the author has not overlooked the fact that measuring the stock market is a mammoth endeavour even for investors of high repute.

The book is not a must-read only for experienced investors, but also for budding investors.

Doing your own research never goes in vain. It not only helps you in your investing journey but also adds to your knowledge. There are several other books available in the market apart from the aforementioned ones.

We have shortlisted a few of them as it may assist you in learning the specifics of investing, trading, and the stock market.

If you want to invest but don’t have much time, you should definitely keep an eye out for Smifs.