The global used construction equipment market, valued at USD 132.4 billion in FY24, is witnessing steady growth driven by rising infrastructure development and construction activity across emerging economies, along with the cost advantage of pre-owned machinery over new equipment. With increasing demand for affordable and efficient construction solutions, the market is projected to expand at a CAGR of 6.0% to reach USD 177.2 billion by FY29, highlighting its role as a vital enabler of capital efficiency in the sector.

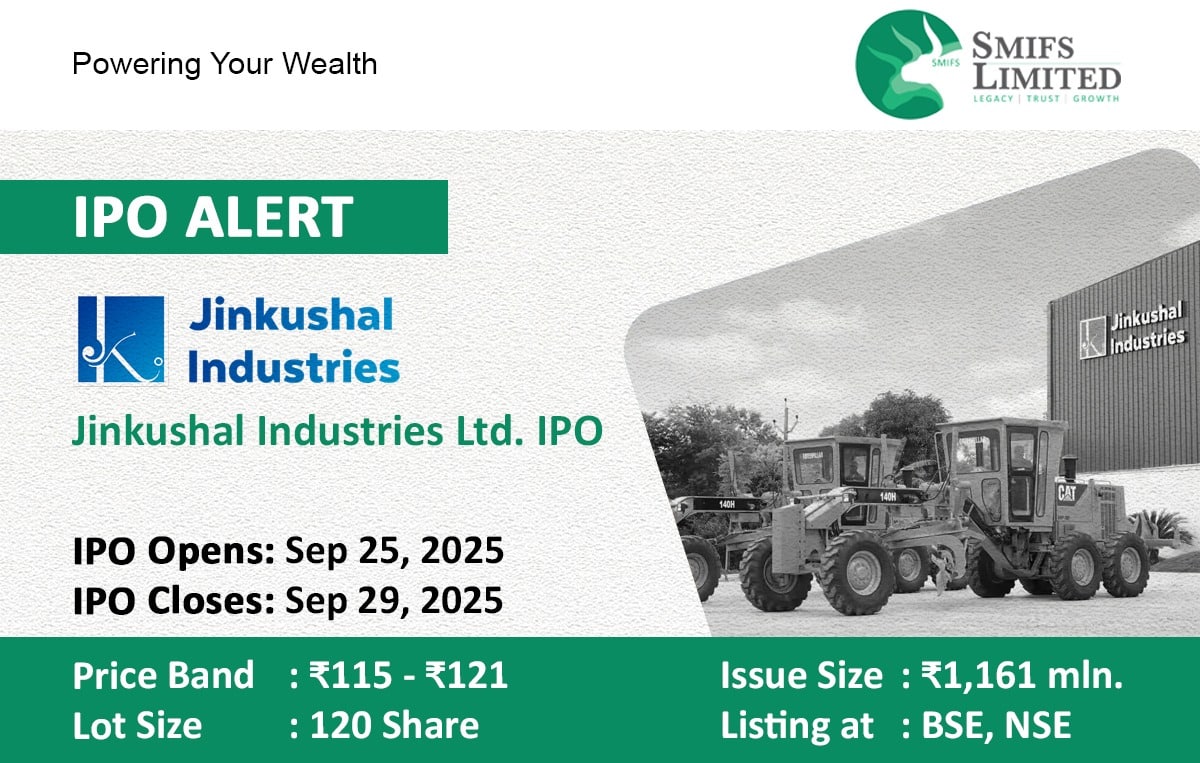

| Detail | Information |

|---|---|

| IPO Open Date | Sep 25, 2025 |

| IPO Close Date | Sep 29, 2025 |

| Price Band | ₹115– ₹121 per share |

| Lot Size | 120 shares |

| Issue Size | ₹1,161 million |

| Listing At | BSE, NSE |

| Tentative Listing Date | To be announced |

Jinkushal Industries Limited, founded in 2007, is an export-focused trading company engaged in supplying construction machinery to over 30 countries, including the UAE, Mexico, Netherlands, Belgium, South Africa, Australia, and the UK. The company operates across three key business verticals: (i) export trading of customised, modified, and accessorised new construction machines; (ii) export trading of used and refurbished construction machines offering cost-effective and reliable alternatives; and (iii) export trading under its proprietary brand ‘HexL’, currently focused on backhoe loaders. With a strong reputation for quality, customisation, and service excellence, the company has established itself as a trusted partner in the global construction equipment market.

Jinkushal Industries demonstrated robust financial performance with revenue from operations growing at an impressive CAGR of 27.4% over FY23-FY25 to reach ₹3,805.58 million in FY25, up from ₹2,334.51 million in FY23, reflecting the company’s strong execution capabilities in construction equipment exports. EBITDA increased from ₹142.35 million in FY23 to ₹233.51 million in FY25, with EBITDA margins remaining healthy at 9.14% in FY25. PAT rose 89.2% from ₹101.17 million in FY23 to ₹191.40 million in FY25, translating to PAT margin improvement from 4.33% to 5.03%, showcasing the company’s ability to translate revenue growth into bottom-line profitability despite competitive pressures. The company maintained healthy return ratios with ROE of 28.30% and ROCE of 18.39% in FY25, while strengthening its balance sheet with net worth more than tripling from ₹245.01 million in FY23 to ₹861.90 million in FY25 and reducing debt-equity ratio to 0.58, highlighting JKIPL’s strong financial foundation and execution track record as India’s largest Non-OEM construction equipment exporter in the rapidly expanding global machinery sector.

Objects of the issue:

- Funding working capital requirements of the company – INR 726.75 million

- General Corporate purposes

📱 Apply Online through the SMIFS ELITE App | Download now:

Experience seamless investing at your fingertips!