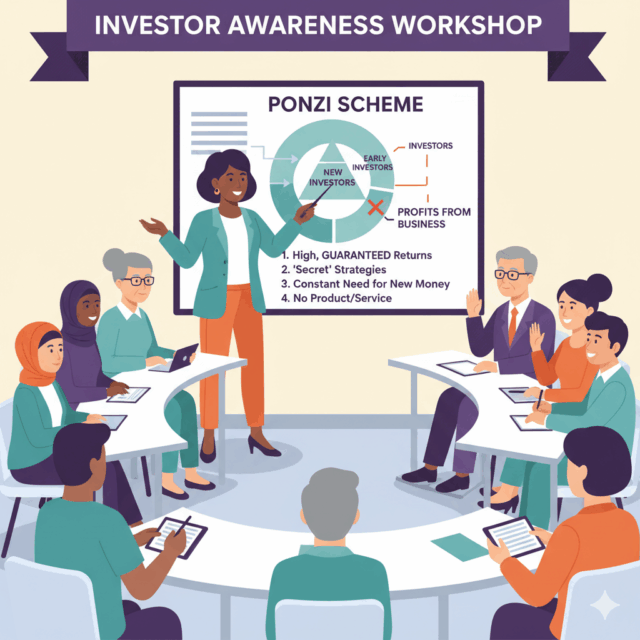

When people put their hard-earned money into investments, they expect it to be used in genuine businesses that generate profits through real products or services. Unfortunately, some fraudsters misuse this trust by creating fake companies or schemes designed to steal money. One of the most notorious forms of such fraud is the Ponzi scheme awareness issue.

This blog explains how Ponzi schemes operate, the warning signs to watch out for, and steps you can take to protect yourself through Ponzi scheme awareness.

What is a Ponzi Scheme?

The term Ponzi scheme traces back to Charles Ponzi, who, in the 1920s, duped thousands of investors with a bogus postage stamp investment. At its core, a Ponzi scheme is a fraudulent investment strategy where money from new investors is used to pay returns to earlier investors — a key reason for promoting Ponzi scheme awareness.

Fraudsters running such schemes lure investors with promises of high returns and little to no risk. In reality, they rarely invest the money anywhere. Instead, they recycle funds to maintain the illusion of profitability while pocketing a large share themselves. This is why Ponzi scheme awareness is crucial for every investor.

How Ponzi Schemes Operate

Ponzi promoters usually attract investors by offering returns that are far above market averages. Early investors do receive payouts, but these are not from actual profits — rather, they are from the money invested by newer participants. This cycle highlights the importance of Ponzi scheme awareness.

Because people see money coming in, they feel reassured and even encourage friends and family to join. Scammers often exploit tight-knit communities, religious groups, or social circles to expand their reach. Ponzi scheme awareness helps prevent such exploitation.

Unlike pyramid schemes, Ponzi schemes don’t always ask participants to recruit others directly. However, the “success stories” of early investors naturally fuel word-of-mouth referrals, allowing the fraud to grow rapidly. Spreading Ponzi scheme awareness can break this chain.

Real-Life Example

A recent case highlights how damaging these schemes can be. Authorities in Alabama, US, charged a 23-year-old man from Gandhinagar, India, for orchestrating a Ponzi scam worth nearly $400,000. He promised investors unusually high returns and assured them that their principal was completely safe. This incident underlines the urgent need for Ponzi scheme awareness.

Instead of investing the funds, he diverted them for gambling, personal expenses, and paying off earlier investors. To make matters worse, he even demanded additional fees under the pretext of maintaining investments. Neither he nor his contracts were registered with regulators, making the entire operation illegal — an example for reinforcing Ponzi scheme awareness.

Warning Signs of a Ponzi Scheme

Ponzi scams often share certain red flags. Recognizing them early can help you avoid becoming a victim:

-

Unrealistic Promises: High or guaranteed returns with no risk should always raise suspicion — a key point in Ponzi scheme awareness.

-

Steady Returns, Regardless of Market Conditions: Genuine investments fluctuate; consistent profits in all conditions are suspicious. This is a vital element of Ponzi scheme awareness.

-

Unregistered Investments: Fraudulent schemes are often not registered with regulators. Registration ensures transparency — part of Ponzi scheme awareness.

-

Unlicensed Sellers: In India, all advisors and intermediaries must be registered with SEBI. Always verify their credentials as part of Ponzi scheme awareness.

-

Complex or Secretive Strategies: If you don’t fully understand where your money is going, that’s a red flag — something Ponzi scheme awareness addresses.

-

Errors in Documentation: Mistakes in account statements can signal that funds are not being handled properly — another warning sign in Ponzi scheme awareness.

-

Difficulty Withdrawing Funds: Delays or excuses when you try to withdraw money are classic warning signs covered under Ponzi scheme awareness.

What to Do if You’ve Been Scammed

If you realize you’ve fallen into a Ponzi trap, take immediate action — guided by Ponzi scheme awareness:

-

Stop making any further payments.

-

Cut off all communication with the fraudsters.

-

Preserve all documents, emails, and transaction records.

-

Report the fraud to the relevant authorities, such as SEBI or law enforcement.

-

Be cautious of recovery scams — fraudsters sometimes resurface, pretending to be officials offering to get your money back for a fee. All these steps are part of Ponzi scheme awareness.

The Bottom Line

Ponzi schemes thrive on greed, trust, and a lack of awareness. While the promise of easy money may sound tempting, remember: if it sounds too good to be true, it probably is. Ponzi scheme awareness is the best defense against such fraud.

Always verify whether an investment opportunity is legitimate, check registrations with SEBI, and avoid putting your money into schemes you don’t understand. By staying alert and informed through Ponzi scheme awareness, you can protect yourself and your loved ones from falling victim to these fraudulent traps.