Azad Engineering Ltd. started its core manufacturing in 2008 and is a player in the energy turbine and aerospace and defence components markets. It is also a manufacturer of oil and gas components. In the energy turbine sector, the company produces rotors and blades for gas turbines and moving and guide blades for a variety of steam turbines. The company has high-precision manufacturing capabilities and caters to prominent OEMs in the energy sector. The company’s manufacturing infrastructure comprises four facilities in India, at Hyderabad with a total manufacturing area of ~20,000 sq. metres. Azad Engineering Ltd.’s aerospace and defence products are largely utilized in commercial and defence aircraft to provide propulsion, actuation, hydraulics, and flight control. Azad’s customers across industries include global OEMs across the energy, aerospace and defence, and oil and gas industries and include General Electric, Honeywell International Inc., Mitsubishi Heavy Industries, Ltd., Siemens Energy, Eaton Aerospace, and MAN Energy Solutions SE.

Investment rationale:

Presence in the energy industry, which is experiencing strong demand for gas turbines:

- Azad Engineering Ltd.’s key customers are in the power and industrial turbine industries. The global gas turbine blade market in 2022 was INR 4,862 crore and is expected to go up to INR 5,094 Cr by 2027.

- The service market for gas turbines accounts for ~60% in 2022 as well as 2027. The new gas-power turbine blades market is directly linked to the growth of the use of gas power, and these are linked to the sale of turbines as sold by OEMs. The replacement is determined by the age of gas turbines, maintenance cycle lengths & overall new technology push.

The presence of Azad Engineering Ltd. in the aerospace and defence industry:

- Azad Engineering Ltd. provides components to the aviation sector, such as engine airfoils and other precision, forged, and machined components.

- The commercial aircraft industry, which was facing significant headwinds post-pandemic, recovered in 2022 and 2023. The outlook for global air traffic is positive with Revenue Passenger kilometres (RPK) expected to increase to 9.5 Bn by 2027, growing at a CAGR of 12%.

- It is projected that domestic air traffic will continue to increase, and by FY30, it is estimated to reach 350 million passengers. Similarly, the international passenger numbers are also expected to rise significantly, reaching 160 million by FY30.

- The global in-service passenger aircraft fleet size in 2023 is around 27,000 across narrow, wide, regional jet, and turboprop segments. Of this narrow and wide-body aircraft account for about 22,000. India’s share in these two segments stands at ~3%, with a fleet size of 630 (out of a total of 726 aircraft).

- However, if the backlog orders are considered, Indian airline operators have around 1,100 planes on order with Airbus SE and The Boeing Company, which translates to a share of ~9% of the global order book.

The presence of Azad in the oilfield industry, which is experiencing strong capex globally,

- Azad Engineering Ltd. supplies components to the oilfield industry, such as drill bits and slips, which are used in the drilling equipment and are part of the exploration and production phase.

- As per IEF and S&P estimates, global O&G upstream spending will reach USD 640 Bn by 2030. Along with the rising costs, the other key drivers for this spending are demand and production. Since historically production growth lagged behind demand growth, this further creates a need for an increase in E&P to ensure stable supply.

Presence across various core industries Azad’s addressable market diversifies revenue sources and increases margins.

- The overall addressable market across energy turbines, aerospace, and defence components for the company is expected to grow at a +7% CAGR from INR 128k Cr in 2022 to INR 181k Cr in 2027.

- Additionally, there is an addressable market for oilfield drilling components, which is expected to grow at +4% CAGR by 2027.

Expanding manufacturing capacity:

- Azad has four advanced manufacturing facilities in Hyderabad, Telangana, India, capable of producing high-precision forged and machined components with a total manufacturing area of approximately 20,000 square metres and a combined annual installed capacity of 642,310 hours per annum, annual actual production of 578,316 hours per annum and capacity utilization of 90% per annum.

- Further, two manufacturing facilities are in the pipeline at (a) Tuniki Bollaram village in Siddipet district, Telangana, and (b) Mangampet village, Sangareddy district, Telangana, with a total manufacturing area of 94,898.78 square metres and 74,866.84 square metres, respectively.

Strong partnership with HAL, which is showing substantial growth in order book:

- HAL, which is a customer of Azad Engineering Ltd., has shown substantial sales growth in recent years, with an over-9% rise in FY23 over FY22.

- As a result of the push for indigenous production, the company anticipates 10% growth in FY24/FY25 and 13%-14% growth shortly. At the end of FY23, Hindustan Aeronautics Limited (HAL) had an order book worth INR 818 Bn.

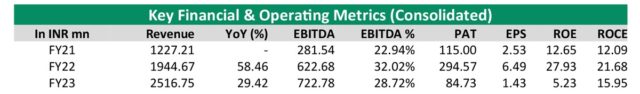

Valuation and outlook: i. The overall addressable market across energy turbine, aerospace, and defence components for the company is expected to grow at +7% CAGR from INR 128k Cr in 2022 to INR 181k Cr in 2027. Additionally, there is an addressable market for oilfield drilling components, which is expected to grow at +4% CAGR by 2027. ii. Azad has two manufacturing facilities in the pipeline at (a) Tuniki Bollaram village in Siddipet district, Telangana, and (b) Mangampet village, Sangareddy district, Telangana, with a total manufacturing area of 94,898.78 square metres and 74,866.84 square metres, respectively. iii. Strong partnership with companies like HAL, which has a substantial order book lined up along with other major clients like General Electric, Honeywell International Inc., Mitsubishi Heavy Industries, Ltd., Siemens Energy, Eaton Aerospace, and MAN Energy Solutions SE. Azad Engineering Ltd. increased its revenue from INR 124 Cr in FY20 to INR 262 Cr in FY23 (CAGR of 28.4% between FY20 – 23) with an EBITDA margin of 31.4% in FY23. The company is one of the fastest-growing manufacturers (in terms of revenue growth for the period between FY20 and FY23), with one of the highest EBITDA margins among the key players mentioned in the report for machined components for the key industries serviced by the company. As of September 30, 2023, the company generated revenue of INR 1,142.92 million from the sale of airfoils and blades for the energy industry, which comprised 72.00% of revenue from operations. Most of the revenues are derived from exports to global OEMs, backed by long-term contracts, and as of September 30, 2023, 89.69% of total revenue was from contracts with customers located outside India. We recommend subscribing to the issue as the moat that the company has built is substantial, and now the scale-up benefits should be visible as Azad is still a small player concerning the TAM available. As the new capacities start contributing, we expect substantial improvement in the numbers.