Flex space operators are playing a pivotal role in India’s office markets, with the top seven markets accounting for ~75–80% of overall office activity. In 2024, flex space contributed 20% of gross leasing, underscoring its growing significance. The segment has expanded rapidly, with stock rising from 18.6 mn sq. ft. in 2018 to 74.0 mn sq. ft. in 2024, a CAGR of 26%, translating to ~7% penetration of total office stock. Post-COVID, flex has consistently accounted for 17–18% of annual gross leasing, reflecting sustained occupier preference. Looking ahead, operational flex stock is expected to double to ~129 mn sq. ft. by 2028, driven by structural demand for flexible office solutions and evolving workplace models.

| Detail | Information |

|---|---|

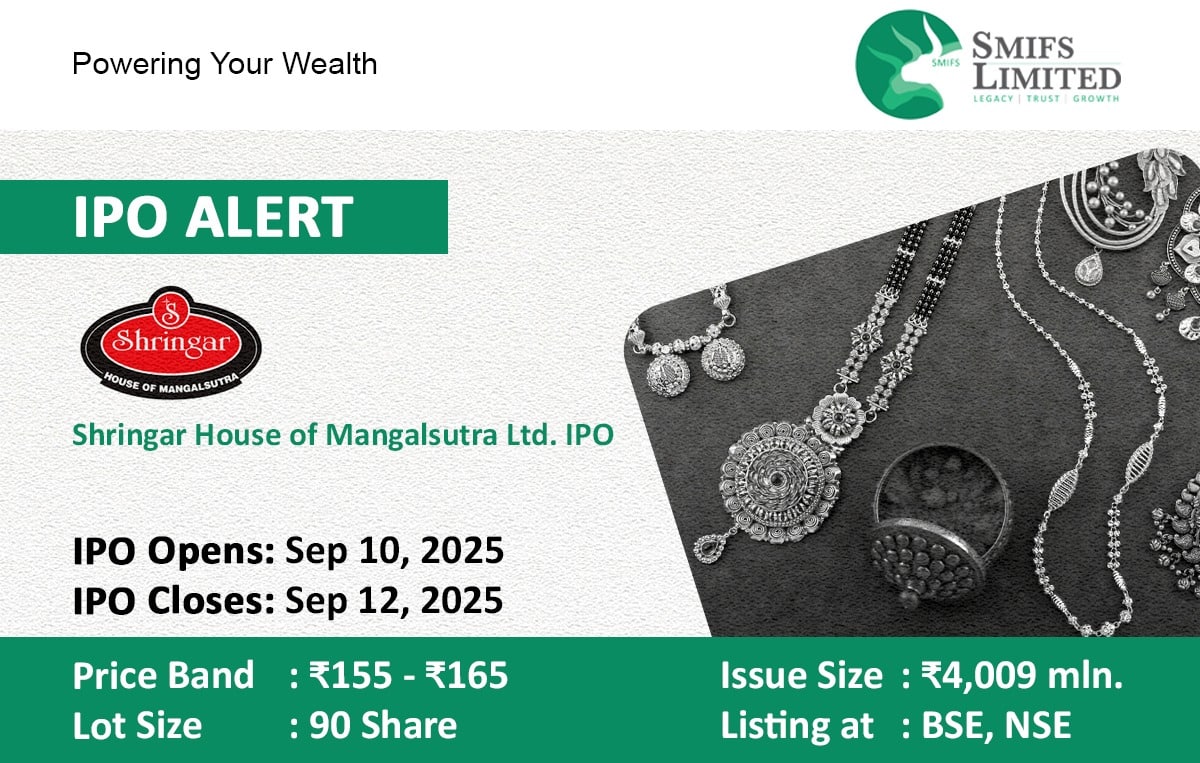

| IPO Open Date | Sep 10, 2025 |

| IPO Close Date | Sep 12, 2025 |

| Price Band | ₹56 – ₹61 per share |

| Lot Size | 235 shares |

| Issue Size | ₹1,433 million |

| Listing At | BSE, NSE |

| Tentative Listing Date | To be announced |

Dev Accelerator Ltd. operates as an integrated platform offering flexible workspace solutions ranging from individual desks to customized private offices. Workspace sourcing and procurement are carried out through multiple models, including Straight Lease, Revenue Share, Furnished by Landlord, and the OpCo–PropCo framework. The company has established a presence across Tier 1 and Tier 2 markets such as Delhi NCR, Hyderabad, Mumbai, Pune, Ahmedabad, Gandhinagar, Indore, Jaipur, Udaipur, Rajkot, and Vadodara. Its services span the full spectrum of office space management, including space sourcing, design customization, development, technology integration, and complete asset management covering property upkeep, HVAC, plumbing, electrical systems, housekeeping, and administrative assistance. As of May 31, 2025, Dev Accelerator manages 28 centers across 11 cities with 14,144 seats and a total super built-up area of 860,522 sq. ft., catering to a diversified client base of over 250 corporates.

Dev Accelerator has delivered a sharp turnaround between FY23–25, with revenue nearly doubling at a 51% CAGR to ₹1,589 mn in FY25, driven by expansion of operational centers (26 vs. 17 in FY23) and sustained high occupancy (87.6% vs. 80.9%). Strong capacity additions (13,759 seats, up 35% over FY23) and efficient utilization have translated into EBITDA of ₹805 mn, with margins holding above 50% despite normalization from FY24’s peak. Profitability improved materially, with PAT of ₹18 mn in FY25 against a loss of ₹128 mn in FY23, supported by scale benefits and cost discipline. Return ratios strengthened sharply, with ROCE expanding to 29.97% in FY25 from just 5.35% in FY23, while deleveraging efforts reduced debt/equity to 2.4x from a stretched 27.2x. The integrated improvement in operational metrics and financials highlights a business that has transitioned from stressed to profitable and capital-efficient, positioning it well for sustained growth.

Objects of the issue:

- CAPEX for fit outs in the proposed centers- INR 731.16 million

- Repayment/Prepayment of borrowings- INR 350 million

- General Corporate Purposes

📱 Apply Online through the SMIFS ELITE App | Download now:

Experience seamless investing at your fingertips!