The Indian chemicals market, valued at approximately USD 235 Bn in CY25 (~4% of the global chemical industry), is poised for strong growth, with total market size expected to reach around USD 380 Bn by CY30 at a CAGR of 10%. Commodity chemicals account for over half of the market, while specialty chemicals, representing 40%, are set to expand at 10-12% CAGR, emerging as the most lucrative segment. India’s chemical industry is among the most diversified globally, and favourable factors such as the global shift towards sustainability, technological advancements, and companies diversifying away from China position the country for accelerated growth. Supported by a robust 15% average revenue growth over the past five years, the sector offers significant investment opportunities, particularly in specialty chemicals, and continues to rank as one of the fastest-advancing industries worldwide.

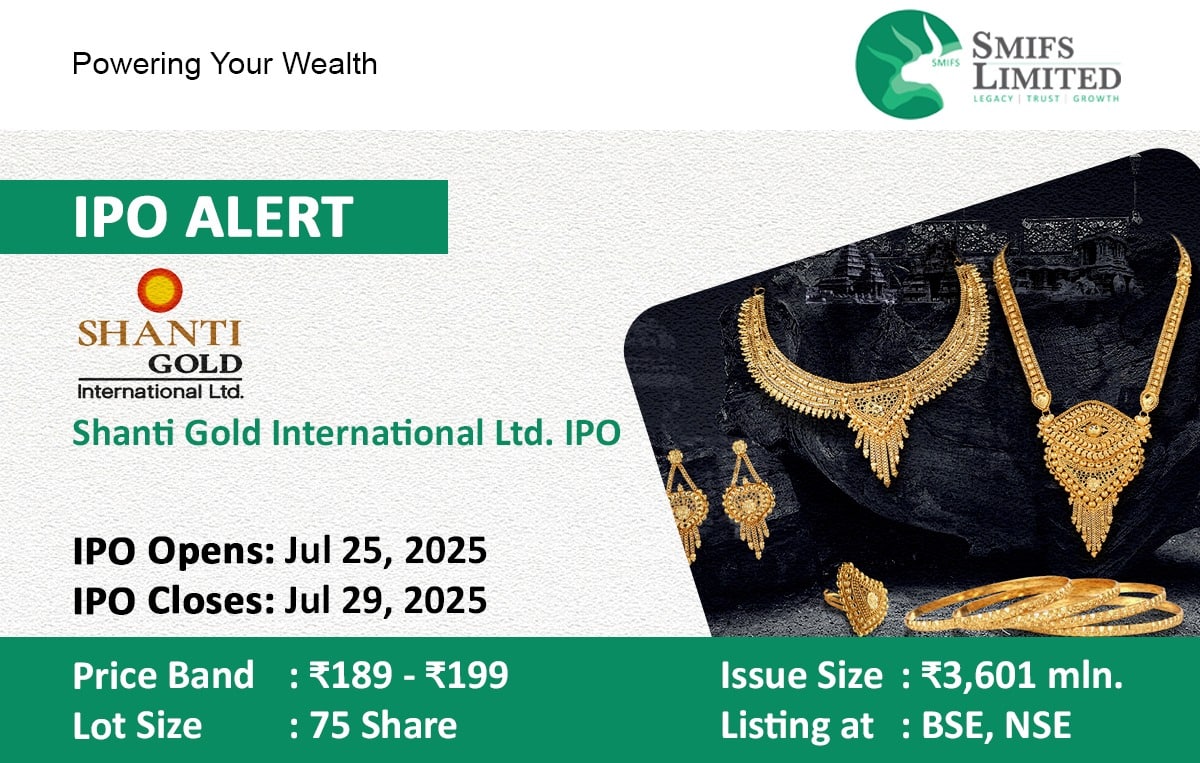

| Particulars | Details |

|---|---|

| IPO Open Date | August 19, 2025 |

| IPO Close Date | August 22, 2025 |

| Price Band | ₹309 to ₹325 per share |

| Lot Size | 46 Shares |

| Issue Size | ₹4,512 mln |

| Listing At | BSE, NSE |

| Tentative Listing Date | [To be announced] |

Gem Aromatics is an established Indian manufacturer of specialty ingredients, including essential oils, aroma chemicals, and value-added derivatives, with over two decades of operational experience. The company offers a diversified product portfolio spanning mother ingredients and their value-added derivatives, catering to industries such as oral care, cosmetics, nutraceuticals, pharmaceuticals, wellness and pain management, and personal care. Recognized as a leading player in essential oils and value-added derivatives, Gem Aromatics specializes in products derived from mint and clove oils, and holds a dominant market position in India across key segments including mint, clove, and eucalyptus oils. Its strong track record, broad portfolio, and brand recall have enabled the company to secure multiple leadership positions within its product categories.

Gem Aromatics has demonstrated strong and consistent financial performance over the past three years. Revenue from operations grew to ₹5,039.53 million in FY25, reflecting an 11.4% year-on-year growth, while gross profit increased to ₹1,280.08 million, with gross margins at a healthy 25.4%. EBITDA rose to ₹884.52 million, representing an EBITDA margin of 17.55%, and profit after tax reached ₹533.84 million, maintaining a solid PAT margin of 10.56%. The company continues to deliver robust returns, with ROE at 18.8% and ROCE at 16.02%, supported by a prudent capital structure and a manageable net debt-to-equity ratio of 0.78x, underscoring its operational strength and financial resilience. the reason behind is nothing but a solid infrastructural changes that led to the dominance of a plastic-based model tht has s strong company fundamental. it fostered economic growth and structure of the company

Objects of the issue:

- Prepayment and repayment of borrowings – INR 1400 million

- General corporate purposes

📱 Apply Online through the SMIFS ELITE App | Download now:

Experience seamless investing at your fingertips!