Investing in the securities market offers exciting opportunities—but what happens when something goes wrong? Whether it’s an unauthorized trade, delay in share transfers, or unresponsive intermediaries, investors should know that they are not alone. The Securities and Exchange Board of India (SEBI) has developed structured mechanisms to address such grievances and ensure transparency, fairness, and accountability in the financial ecosystem.

In this blog, we’ll explore the different avenues for grievance redressal in the securities market, focusing primarily on the SCORES platform (SEBI Complaints Redress System), and other support systems provided by stock exchanges.

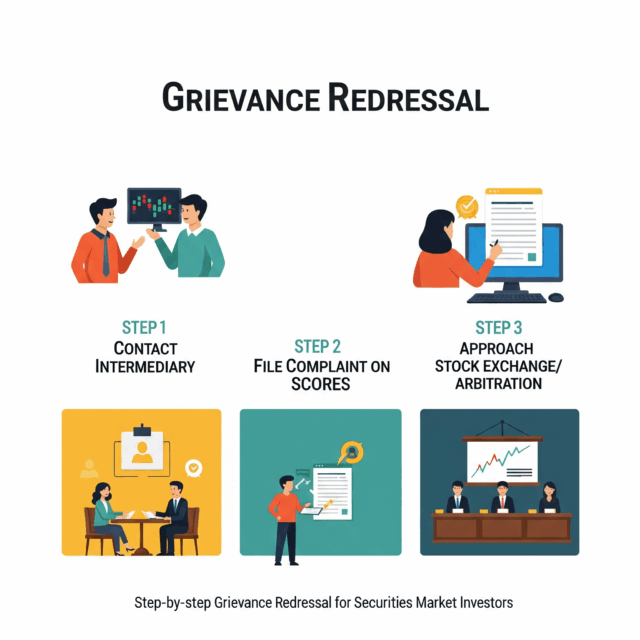

Step 1: Approach the Intermediary or Company First

Before escalating any grievance to SEBI or the stock exchanges, it is essential that you first contact the intermediary or company involved in the issue. This could be:

- A stock broker

- A depository participant

- A listed company

- A registrar and transfer agent (RTA)

- A mutual fund house

- Or any other SEBI-registered entity

The concerned intermediary is obligated to acknowledge and resolve the complaint in a time-bound manner. In many cases, grievances get resolved at this stage through internal communication.

However, if the issue is not satisfactorily resolved even after following up, you can move to the next level: lodging a formal complaint with SEBI via SCORES.

Step 2: Use the SEBI Complaints Redress System (SCORES)

What is SCORES?

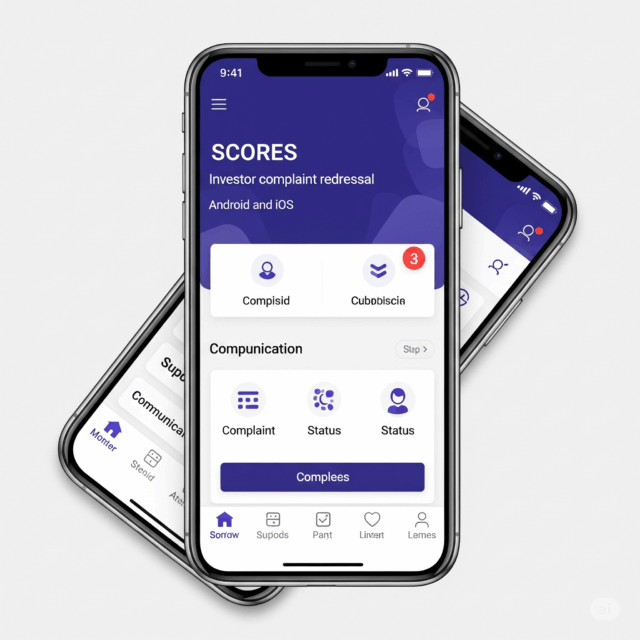

SCORES (SEBI Complaints Redress System) is a web-based centralized grievance redressal platform developed by SEBI. It allows investors to lodge, track, and follow up on complaints online—anytime, from anywhere.

The portal ensures transparency in the complaint resolution process and enables SEBI to monitor and intervene when necessary.

How to Access SCORES?

You can register and file complaints through:

- The SCORES website: http://scores.gov.in

- The SCORES mobile app, available on both Android and iOS platforms

These platforms are user-friendly and allow investors to submit complaints with supporting documents.

Key Features of SCORES

- 24×7 Online Access: Lodge complaints at your convenience, without visiting any physical office.

- Complaint Tracking: Each complaint is assigned a unique registration number which can be used to track its status in real time.

- Transparency and Accountability: Intermediaries and companies are required to respond and act within specific timelines. SEBI monitors the entire process.

- Evidence Upload: You can upload documents and evidence to support your claim.

- Multiple Channels: SCORES is accessible via web and mobile app, ensuring reach even in remote locations.

How to File a Complaint on SCORES?

- Register Yourself

Visit http://scores.gov.in and click on “Investor Corner” → “Register Here.” Fill in your name, email, phone number, and PAN to create an account. - Login and Lodge Complaint

After logging in, select the relevant category (stock broker, mutual fund, listed company, etc.) and fill in the complaint details clearly. Upload supporting documents or screenshots as evidence. - Track Your Complaint

Use your complaint reference number to monitor the response status, timelines, and SEBI’s intervention (if applicable).

Step 3: Contact Stock Exchanges If Needed

If the issue remains unresolved or if the intermediary is a trading member or a listed entity, you may also approach the concerned Stock Exchange or Depository.

Each stock exchange has its own redressal committees and investor service cells designed to handle grievances efficiently.

Redressal Committees at Stock Exchanges

Redressal Committees at Stock Exchanges

NSE: Investor Grievance Resolution Panel (IGRP)

The National Stock Exchange (NSE) facilitates grievance redressal through the IGRP, which looks into complaints filed against its trading members or listed companies.

BSE: Investor Grievance Redressal Committee (IGRC)

The Bombay Stock Exchange (BSE) addresses investor complaints through the IGRC, which offers resolution via non-judicial methods like arbitration.

MSE: Similar Redressal Framework

The Metropolitan Stock Exchange (MSE) follows a similar mechanism and cooperates with investors to resolve complaints efficiently and fairly.

Investor Services Cells: A Local Support System

In addition to SCORES and central redressal committees, SEBI and stock exchanges have established Investor Service Cells (ISCs) across various regions in India.

These cells are dedicated to:

- Resolving investor queries and complaints

- Assisting in communication with brokers and listed companies

- Guiding investors on legal rights and documentation

- Offering support in arbitration or quasi-judicial proceedings when required

A detailed list of Investor Service Centers and their contact details is available on the respective websites of NSE, BSE, and MSE.

Arbitration: For Dispute Resolution

If the complaint escalates into a dispute that cannot be resolved amicably, investors have the option to initiate arbitration proceedings through the stock exchanges. Arbitration provides a cost-effective, faster alternative to court proceedings and is facilitated by SEBI-approved panels.

SEBI Toll-Free Helpline

Need assistance? SEBI offers toll-free helplines to address investor concerns and guide users through the SCORES platform:

📞 1800 22 7575

📞 1800 266 7575

These helplines operate during business hours and are available in multiple languages.

Important Tips for Using SCORES Effectively

- Lodge complaints promptly, with accurate information and supporting documents.

- Always keep copies of your previous communications with the intermediary.

- Use polite and professional language in all complaint submissions.

- Monitor your complaint regularly and respond to any clarification requests from SEBI or the intermediary.

- Do not lodge frivolous or baseless complaints, as this can affect your credibility in future matters.

Final Thoughts

SEBI’s SCORES platform and the associated investor grievance redressal systems ensure that no investor is left unheard. With online complaint tracking, local service centers, arbitration facilities, and proactive monitoring, the Indian securities market offers robust protection for retail investors.

If you ever feel that you’ve been wronged in the market—don’t remain silent. Start by contacting your intermediary, and if needed, escalate it through SCORES or the stock exchange. In doing so, you not only stand up for your rights but also contribute to a fairer and more transparent market for everyone.

Disclaimer: This article is for educational purposes only and does not constitute legal or financial advice. For detailed guidance, visit http://scores.gov.in or consult SEBI directly.

Redressal Committees at Stock Exchanges

Redressal Committees at Stock Exchanges