Innova Captab is an integrated pharmaceutical company in India with a presence across the pharmaceutical value chain, including research and development, manufacturing, drug distribution and marketing, and exports. Their business includes (i) a CDMO business providing research, product development, and manufacturing services to Indian pharmaceutical companies; (ii) a domestic-branded generics business; and (iii) an international-branded generics business. In FY22, among Indian formulation, CDMO players Innova recorded the third highest operating revenue, the second highest operating profit margin, the third highest net profit margin and the second highest return on capital employed. In FY21, FY22, FY23, and the three months ended June 30, 2023, the total installed capacity of Innova, on a combined basis (not including Sharon), was 4,239.31 million, 5,556.73 million, 8,191.59 million tablets, and 2,047.90 tablets, respectively, and 1,591.20 million, 2,048.16 million, 2,472.48 million, and 618.12 million capsules, respectively, during the same periods. In FY21, FY22, and FY23, and in the three months ended June 30, 2023, the aggregate manufacturing capacity utilisation on a combined basis (not including Sharon) for tablets was 66.49%, 54.61%, 40.68%, and 46.72%, respectively, and for capsules it was 60.03%, 52.04%, 55.49%, and 65.98%, respectively.

Investment Rationale:

Growth in the global pharmaceutical market to benefit the international branded generics business:

- The global pharmaceutical market has grown at a CAGR of 5% from approximately US$ 1,135 billion in the calendar year 2017 to approximately US$ 1,457 billion in the calendar year 2022.

- It is expected to sustain 4.5–5% CAGR growth over the next five years, from 2022 to 2027 to reach approximately US$1,750–1,800 billion in CY27.

- The global injectable market registered a CAGR of approximately 8-9% during the abovementioned period to reach approximately US$ 576 billion in CY22. We expect the market to grow at a 6-7% CAGR to reach US$750–800 billion by the end of CY27.

Indian CDMO segment to sustain its strong growth trajectory over fiscals 2023-2028, where Innova has the third highest manufacturing capacity:

- Supported by strong growth sustained by the global pharmaceutical industry and a rise in India’s export potential, it is projected that the Indian CDMO market (including domestic and exports) will grow at a CAGR of approximately 12–14% from Rs. 1,310 billion in FY23 to Rs. 2,400 to 2,500 billion in FY28.

- Innova Captab Limited manufactures products across some of the key therapeutic areas like cephalosporins, proton pump inhibitors, Anticholinergic & heparin NSAIDs, Analgesics & Antipyretic, Anticold & antiallergic, Antiemetic, Antidiabetic, Antispasmodic, Antifibrinolytic, Cardiovascular, Antioxidant & Vitamins, Antihyperuricemia & Antigout, Fluroquinolone & Macrolide, Nootropics & Neurotronic/Neurotrophic, Antiulcerative , Antimalarial anxiolytic, Anticonvulsant & Antipsychotic, Bladder & Prostate disorders, Antifungal, Anthelmintic & Antiviral, Anticholinergic , Anti-asthmatic & Bronchodilator and erectile dysfunction.

- In terms of capacity for manufacturing finished tablets and capsules, Innova Captab Limited stood third among the CDMO formulation players with a manufacturing capacity of 10,664 million units per annum.

Innova Captab looking to grow inorganically:

- In FY24, they had 72 new therapeutic generic products in the development stage and expect that 30 new generic products will be commercialized in FY24.

- Further Innova has 218 fresh registration applications in process with international authorities and has begun preliminary research on over 15 formulations that had gone (or are going) off-patent.

The strategic acquisition of Sharon benefitting Innova:

- Innova Captab infused INR 1,954.00 million into Sharon on June 26, 2023, Sharon is engaged in the business of manufacturing of intermediates and active pharmaceutical ingredients as well as finished dosages.

- It also offers contract manufacturing services for formulations.

Valuation and outlook:

i. The Indian CDMO market is projected to grow at approximately a 12–14% CAGR over the next five years, from INR 1,310 billion in FY23 to INR 2,400–2,500 billion in FY28, where Innova has the third highest manufacturing capacity of 10,664 million units per annum.

ii. The strategic acquisition of Sharon, which is engaged in the business of manufacturing intermediates and active pharmaceutical ingredients as well as finished dosages.

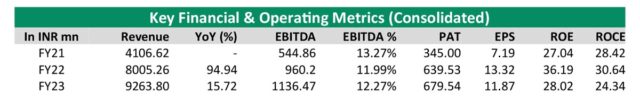

iii. It is expected to sustain 4.5–5% CAGR growth over the next five years from 2022 to 2027 to reach approximately US$1,750 to US$1,800 billion in CY27. Revenue from operations has grown at a 50.19% CAGR from INR 4,106.62 million in FY21 to INR 9,263.80 million in FY23. Revenue from operations was INR 2,332.43 million in the three months ended June 30, 2023. Revenue from operations on a consolidated basis was INR 11,185.96 million in FY23. Trade receivables on a restated consolidated basis increased from INR 2,126.86 million in FY22 to INR 2,652.18 million in FY23, due to an increase in revenue as a normal trend. Trade receivables on a restated consolidated basis as a percentage of revenue from operations increased from 26.57% for FY22 to 28.63% for FY23 due to an increase in revenue and normal business trends. Domestic and international export-branded generics businesses have been growing rapidly. During FY21, FY22, and FY23, and during the three months ended June 30, 2023, revenue from domestic branded generic business on a consolidated basis was nil, INR 370.51 million, INR 1,661.61 million, and INR 422.53 million, respectively. Revenue from domestic-branded generic businesses on a consolidated basis was INR 1,661.61 million in FY23. We recommend a subscription to the issue as the entry into some developed markets and new product launches should aid improved capacity utilisation; the integration of the recent takeover should also aid earnings and product basket expansion; and the company is looking to attain growth both organically and inorganically.