The pre-engineered buildings (PEB) segment has witnessed robust growth in recent years, driven by increasing automation in the construction industry, a shortage of skilled labour, and the rising demand for faster, cost-effective, and sustainable building solutions. These structures offer key advantages such as reduced material wastage, enhanced quality control, and improved on-site safety, making them more eco-friendly compared to conventional construction. The Indian PEB industry grew at a CAGR of 8.3% between FY19 and FY25, reaching ₹210 billion in FY25 from ₹130 billion in FY19. Globally, the PEB market expanded to an estimated $20-22 billion in 2024 from $15-17 billion in 2019. Similarly, India’s self-supported roofing segment grew at a CAGR of 6.1% over the same period to reach ₹3.0 billion in FY25, underscoring the growing preference for modular, high performance steel-based construction solutions.

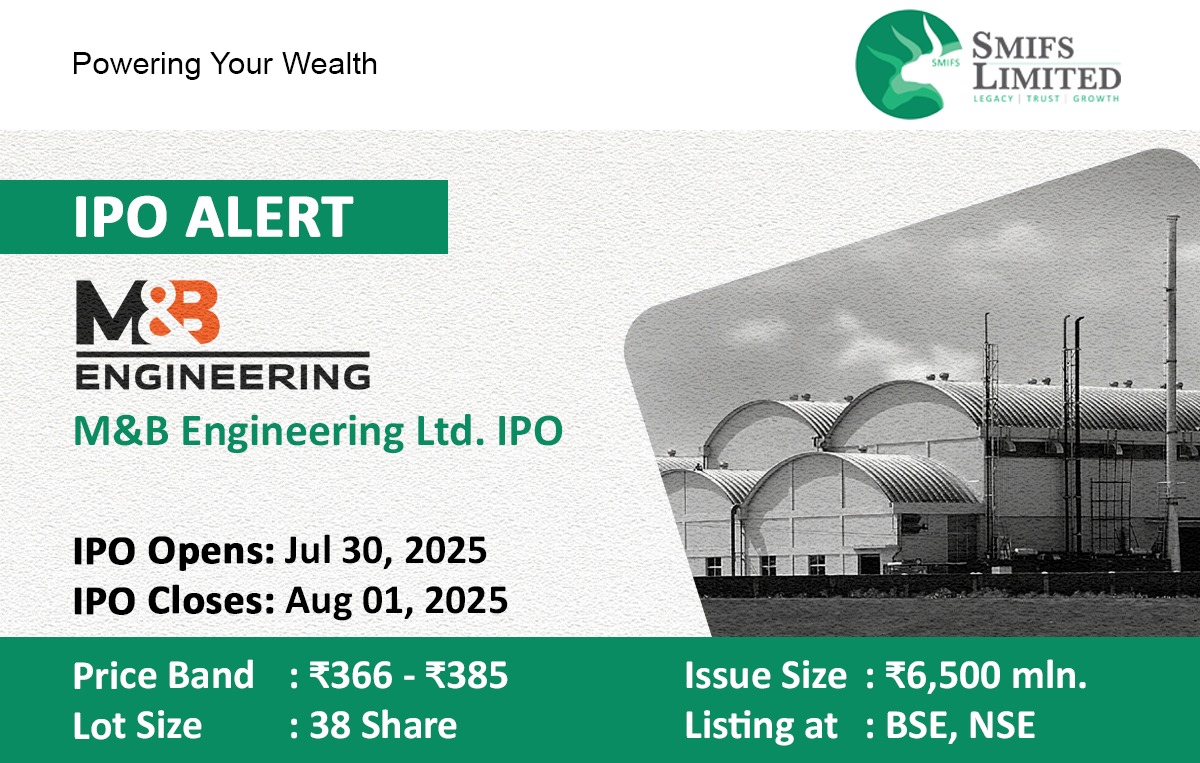

| Particulars | Details |

|---|---|

| IPO Open Date | July 30, 2025 |

| IPO Close Date | August 01, 2025 |

| Price Band | ₹366 to ₹385 per share |

| Lot Size | 38 Shares |

| Issue Size | ₹6, 500 mln |

| Listing At | BSE, NSE |

| Tentative Listing Date | [To be announced] |

Incorporated in 1981, M&B Engineering Limited is a leading provider of pre-engineered buildings (PEBs) and self-supported steel roofing solutions in India, with a strong focus on design-led, high-performance manufacturing. The company delivers end-to-end services encompassing design, engineering, manufacturing, and testing, catering to diverse sectors such as general engineering, manufacturing, food and beverages, warehousing, logistics, power, textiles, and railways. It operates two advanced manufacturing facilities in Sanand, Gujarat and Cheyyar, Tamil Nadu with a combined PEB production capacity of 103,800 MTPA. Through its Phenix Division, M&B Engineering offers integrated PEB solutions using advanced design and production technologies, while its Proflex Division specializes in on-site fabrication and installation of self-supported steel roofing systems. With a strong global footprint, the company exports PEBs and structural steel components to 22 countries, including the USA, Brazil, South Africa, and Qatar, and has successfully executed over 9,500 projects as of FY25.

M&B Engineering Limited has delivered a strong and consistent financial performance over FY23-FY25, underscoring its operational resilience and growth potential. Revenue from operations rose steadily from ₹8,804.70 million in FY23 to ₹9,885.54 million in FY25, supported by healthy execution across business verticals. EBITDA nearly doubled over the same period to ₹1,263.77 million, with margins expanding significantly from 7.54% to 12.78%, reflecting enhanced operating leverage and cost efficiency. Profit after tax saw robust growth, rising from ₹328.92 million in FY23 to ₹770.47 million in FY25, with PAT margins improving from 3.70% to 7.73%, indicating strong bottom-line expansion. Return ratios strengthened meaningfully, with ROE increasing from 18.89% to 25.13% and ROCE from 19.70% to 24.80%, showcasing efficient capital deployment and improved profitability. Notably, the company has maintained a conservative capital structure despite its scale-up, with net debt-to-equity improving to a comfortable 0.33x in FY25, highlighting disciplined financial management and a healthy balance sheet.

Objects of the issue:

- Funding Capex requirements at their Manufacturing facilities – INR 1305.79 million

- Investment in IT software upgradation – INR 52 million

- Prepayment and Repayment of borrowings – INR 587.5 million

- General corporate purposes

📱 Apply Online through the SMIFS ELITE App | Download now:

Experience seamless investing at your fingertips!