Rishabh Instruments Ltd. (RIL) is a global energy efficiency solution company focused on electrical automation, metering and measurement, precision engineered products, with diverse applications across industries including power, automotive and industrial sectors. The company supplies a wide range of electrical measurement and process optimization equipment, and are engaged in designing, developing and manufacturing, and sale of devices significantly under its own brand across several sectors. It also provides complete Aluminum high-pressure die-casting solutions through its subsidiary Lumel Alucast. RIL’s product portfolio consists of over 145 product lines catering primarily in a B2B business model with a network of 167 authorized distributors/stockists across 81 districts in India with direct sales conducted through eight sales and marketing offices which collectively house 53 engineers and 23 sales personnel.

Investment Rationale:

Growth in the electrical automation industry in India which is outperforming the global market boosts RIL’s

prospects:

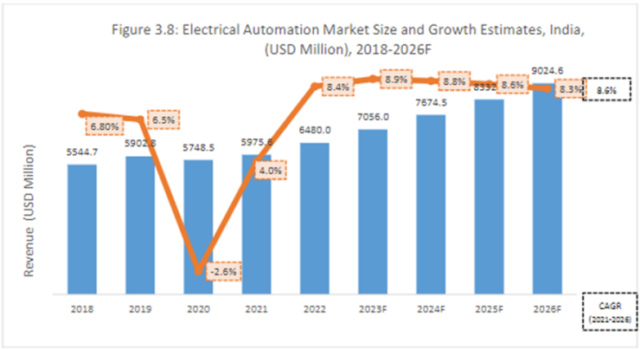

- The Indian Electrical Automation market was valued at INR 58320.31 crores in 2023 and is forecasted to grow at a

CAGR of 8.6% (against 7.9% CAGR of global) to reach INR 74591.48 crores by 2026. - Rishabh Instruments is the number one player in electrical transducers in India and holds approximately 37% of

market share and with respect to TAM, it holds 0.07% market share in the electrical automation segment.

Rising adoption of Industrial Internet of Things (IIoT) solutions in the electrical automation industry:

- The electrical automation market had depended on huge CAPEX investments, but a shift to TOTEX (CAPEX + OPEX)

is likely to encourage the adoption of Industrial Internet of Things (IIoT) solutions and increase the demand for

electrical automation. - With the rise of IIoT and as-a-service models, the investment focus is shifting to OPEX and TOTEX, which allows

projects to progress without the burden of high CAPEX investments—an important factor, especially for small and

medium-sized companies. Products such as Sensors and Transmitters, HMI, Temperature controllers, Chart

Recorders, and I/O Converters are expected to witness increased demand which will be beneficial for RIL.

Strong global growth across all the operating segments drives prospects:

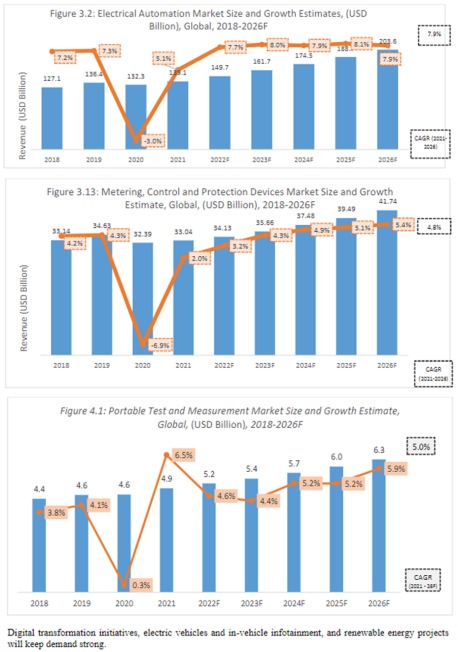

- The global electrical automation market is valued at USD 161.07 billion in 2023 and is expected to grow at a CAGR

of 7.9% to reach USD 203.6 billion by 2026. - The global metering, control and protection devices market is estimated at USD 33.168 billion in 2023 and is

expected to witness a 4.8% CAGR to reach USD 41.7 billion by 2026. - The portable test and measurement market stands at USD 5.39 billion in 2023. The market is expected to grow at

5% and reach USD 6.3 billion by 2026. The solar string inverters industry the global revenue for solar string inverters

is expected to increase from USD 4.72 billion in 2023 to USD 6.2 billion in 2026, at a CAGR of 9%.

Diversified product portfolio:

- The company is a global leader in manufacturing and supply of analog panel meters, and it is among the leading

global companies in terms of manufacturing and supply of low voltage current transformers. Lumel is the most

popular brand in Poland for meters, controllers, and recorders and Lumel Alucast is one of the leading non-ferrous

pressure casting players in Europe. - It has a product portfolio of over 145 product lines and 0.13 million stock-keeping units as of May 31, 2023. In FY23,

FY22 and FY21 it manufactured an aggregate of 16.21 million units, 14.02 million units and 13.35 million units of

products across its product lines, respectively.

Strategic Capacity Expansion of Nashik Facility I:

- RIL has total installed manufacturing capacity of 22.2 Mio products per annum. In addition, it has 2 modification

centers –one each in the United Kingdom and the United States. - The company aims to expand Nashik Manufacturing Facility I to build capacity for manufacturing of electrical

automation products, metering, control and protection devices and solar string inverters.

Special incentive schemes benefitting the company:

- RIL is eligible for the Modified Special Incentive Package Scheme, which provides a capital subsidy of 25% for

investment in capital expenditure on plant and machinery to units situated outside SEZs that are engaged in

designing and manufacturing of electronic and nano-electronic products and their accessories. - This will benefit the company in its current and future capacity expansion projects.

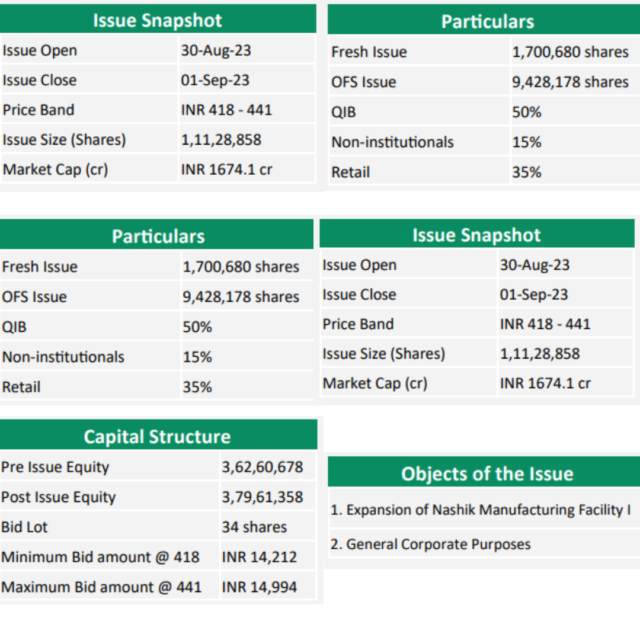

Valuation and Views: RIL is looking to benefit from: i. Continued growth in the electrical automation industry where the

company is a leader in electrical transducers. ii. Diversified product portfolio. iii. Strategic expansion of Nashik facility to

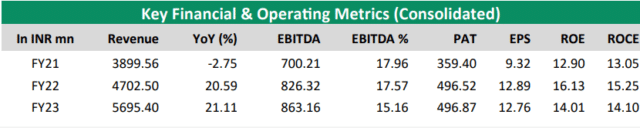

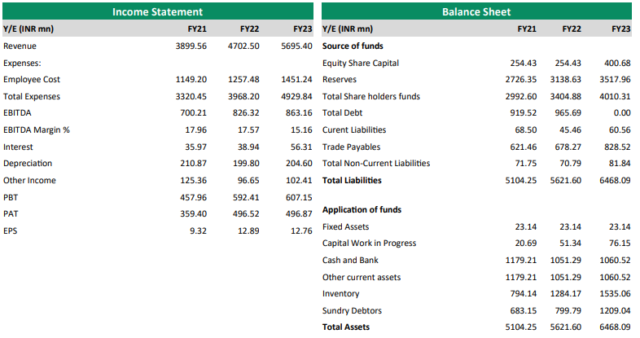

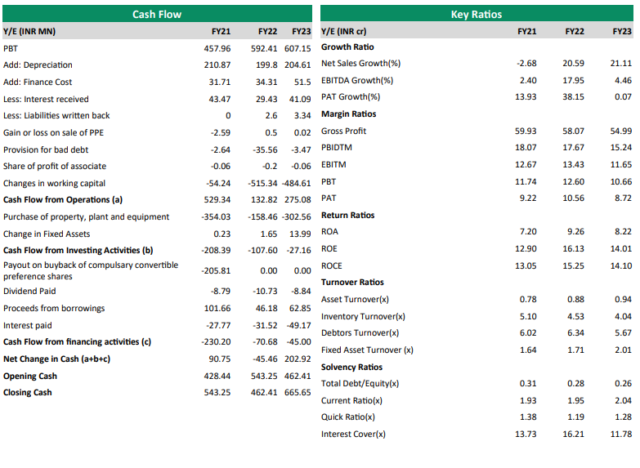

cater to the growing demand for products across various segments. RIL’s total income increased by 20.81% from INR

4,799.15 million in FY22 to INR 5,7997.15 million in FY23. The company recorded an increase in its PAT for the year by

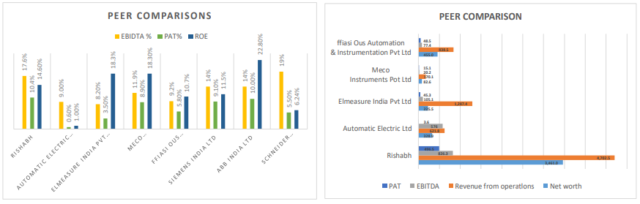

0.07% from INR 496.52 million in FY22 to INR 496.87 million in FY23. In FY23, FY22 and FY21 the company’s ROE was

14.01%, 16.13% and 12.90% respectively. During the same period the company’s Debt/Equity stood at 0.26%, 0.21% and

0.31% respectively. At upper end of the price band, the P/E translates to ~33.68x on FY23 EPS of INR 13.09. We believe

the company has scope to grow given only ~50-60% capacity utilisation leaving scope for future growth. RIL has twin

engines where the traditional business should continue to grow steadily while the new segments like electric

automation, solar string inverter industry’s growth should provide the much needed kick both globally and in India, we

recommend a subscribe to the issue.

Rishabh Instruments Ltd. (RIL) is a global energy efficiency solution company focused on electrical automation, metering and measurement, precision engineered products, with diverse applications across industries including power, automotive and industrial sectors. The company supplies a wide range of electrical measurement and process optimization equipment, and are engaged in designing, developing and manufacturing, and sale of devices significantly under its own brand across several sectors. It also provides complete aluminium high-pressure die casting solutions through its subsidiary Lumel Alucast for customers requiring close tolerance fabrication (such as automotive compressor manufacturers and automation high precision flow meters manufacturing and supply of analog panel meters, and it is among the leading global companies in terms of manufacturing and supply of low voltage current transformers. Lumel is the most popular brand in Poland for meters, controllers, and recorders and Lumel Alucast is one of the leading non-ferrous pressure casting players in Europe. RIL’s product portfolio consists of over 145 product lines catering primarily in a B2B business model with a network

of 167 authorized distributors/stockists across 81 districts in India with direct sales conducted through eight sales and

marketing offices which collectively house 53 engineers and 23 sales personnel.

Investment rationale: Growth in the electrical automation industry in India which is outperforming the global market boosts RIL’s prospects: The Indian Electrical Automation market was valued at INR 58320.31 crores in 2023 and is forecasted to grow at a CAGR of 8.6% (against 7.9% CAGR of global) to reach INR 74591.48 crores by 2026. In India, Automotive and transportation, food and beverage, FMCG, chemicals and textiles are major end users. Steel, semiconductor and defense growth is less due to muted economic situation across the globe. Building automation and data centers are the emerging end-user segments. The push for localized manufacturing, development of IT infrastructure and home automation systems can be seen as driving factors for electrical automation components. In India, the market is dominated by international players. The top 5 companies occupy approximately 50% market share. Local players compete with global brands on price points and customer service and are emerging competition. Industrial end users prefer a single vendor for all their needs, so international

players like Rishabh have an advantage because of their wide product portfolio in this segment. Local players form a major part of others (48.8%) and in large part supply SMEs that make up the country’s manufacturing base in India. Rishabh Instruments is the number one player in electrical transducers in India and holds approximately 37% of market share and with respect to TAM, it holds 0.07% market share in the electrical automation segment. Rising adoption of Industrial Internet of Things (IIoT)

solutions in the electrical automation industry: The electrical automation market had depended on huge CAPEX investments, but a shift to TOTEX (CAPEX + OPEX) is likely to encourage the adoption of Industrial Internet of Things (IIoT) solutions and increase the demand for electrical automation. With the rise of IIoT and as-a-service models, the investment focus is shifting to OPEX and TOTEX, which allows projects to progress without the burden of high CAPEX investments—an important factor, especially for small and medium-sized companies. Products such as Sensors and Transmitters, HMI, Temperature controllers, Chart Recorders, and I/O Converters are expected to witness increased demand which will be beneficial for RIL.

Strong global growth across all the operating segments drives prospects: The global electrical automation market is valued at USD 161.07 billion in 2023 and is expected to grow at a CAGR of 7.9% to reach USD 203.6 billion by 2026. The global metering, control and protection devices market is estimated at USD 33.168 billion in 2023 and is expected to witness a 4.8% CAGR to reach USD 41.7 billion by 2026. Portable test and measurement equipment play a central role in enabling digital transformation, IoT, Industry 4.0 and autonomous living as the need for highly reliable and advanced electronic devices increase. The portable test and measurement market stands at USD 5.39 billion in 2023. The market is expected to grow at 5% and reach USD 6.3 billion by 2026. The solar string inverters industry the global revenue for solar string inverters is expected to increase from USD 4.72 billion in 2023 to USD 6.2 billion in 2026, at a CAGR of 9%. Commercial and residential rooftop solar installations are driving the market’s growth. RIL is looking to benefit from the growth in all these segments due to its diversified product offering in all these various segments where the company is a market leader. Rishabh is a global leader in manufacturing and supply of analog panel meters, and is among the leading global companies in terms of manufacturing and supply low voltage current transformers. Lumel is one of the leading non-ferrous pressure casting players in Europe. With over 145 product lines and catering to over 3000 customers globally, Rishabh Instruments has undisputedly positioned itself as a leading player within the space. Key market positioning of Rishabh Instruments, globally and locally are; global leader in manufacturing and supply of analog panel meters, leading global companies in terms of manufacturing and supply of low voltage current transformers. Lumel the most popular brand in Poland for meters, controllers and recorders (Lumel). Lumel is a leading player in non-ferrous pressure casting in Europe. The Lumel Alucast factory melts 20 tons of aluminium per day and produce 35,000 castings per day. European car production is 9.9 million units/annum and Lumel produces 3 million of aluminum cast housing for the car compressor makes it one of the leading die-cast players in Europe. In India RIL is the number 1 player in electrical transducers and number 1 player in split core current transformers. It is also the first company in India to Design, Develop & Manufacture Solar String Inverters end to end.

Diversified product portfolio: The company is a global leader in manufacturing and supply of analog panel meters, and it is among the leading global companies in terms of manufacturing and supply of low voltage current transformers. Lumel is the most popular brand in Poland for meters, controllers, and recorders and Lumel Alucast is one of the leading non-ferrous pressure casting players in Europe. It has a product portfolio of over 145 product lines and 0.13 million stock-keeping units as of May 31, 2023. In FY23, FY22 and FY21 it manufactured an aggregate of 16.21 million units, 14.02 million units and 13.35 million units of products across its product lines, respectively. Its panel instruments are used not only in the electrical switch boards which are used for distribution of electricity, but also for industrial applications such as multiload monitoring, cloud and connectivity, and energy monitoring systems. In a fragmented portable TMI market where both Indian and Chinese players limit themselves to low-end maintenance and repair solutions, it has extended its offerings to professional industrial TMI products capable of serving needs in modern laboratories and even aerospace.

Strategic Capacity Expansion of Nashik Facility I: RIL has total installed manufacturing capacity of 22.2 Mio products per annum. In addition, it has 2 modification centers –one each in the United Kingdom and the United States. The company aims to expand Nashik Manufacturing Facility I to build capacity for manufacturing of electrical automation products, metering, control and protection devices and solar string inverters. RIL also plans to invest in automation of certain assembly and test operations to achieve cost efficiency. The Expansion Project entails (a) construction of a building and civil work; (b) procurement and installation of plant and machinery for expanding the production capacity of analog panel meters, digital panel meters, multimeters, current transformers, electrical transducers, moulds and solar inverters; and (c) other necessary utilities. They intend to utilize INR 59.49 crores of the net proceeds towards the cost of the expansion project.

Special incentive schemes benefitting the company: RIL is eligible for the Modified Special Incentive Package Scheme, which provides a capital subsidy of 25% for investment in capital expenditure on plant and machinery to units situated outside SEZs who are engaged in designing and manufacturing of electronic and nano-electronic products and their accessories. This will benefit the company in its current and future capacity expansion projects.

Valuation and Views: RIL is looking to benefit from: i. Continued growth in the electrical automation industry where the company is a leader in electrical transducers. ii. Diversified product portfolio. iii. Strategic expansion of Nashik facility to cater to the growing demand for products across various segments. RIL’s total income increased by 20.81% from INR 4,799.15 million in FY22 to INR 5,7997.15 million in FY23. The company recorded an increase in its PAT for the year by 0.07% from INR 496.52 million in FY22 to INR 496.87 million in FY23. In FY23, FY22 and FY21 the company’s ROE was 14.01%, 16.13% and 12.90% respectively. During the same period the company’s Debt/Equity stood at 0.26%, 0.21% and 0.31% respectively. At upper end of the price band, the P/E translates to ~33.68x on FY23 EPS of INR 13.09. We believe the company has scope to grow given only ~50-60% capacity utilisation leaving scope for future growth. RIL has twin engines where the traditional business should continue to grow steadily while the new segments like electric automation, solar string inverter industry’s growth should provide the much needed kick both globally and in India, we recommend a subscribe to the issue.

To read the official report please visit: Rishabh Instruments Ltd. IPO Note