India’s cargo handling capacity is poised for strong growth, with port volumes projected to rise at a CAGR of 10.80% from 1,540 MMT in FY24 to 2,849 MMT by FY30, driven by expanding trade activity and infrastructure development. Gujarat, a key maritime hub with one major port (Deendayal Port, Kandla) and 48 minor ports, is expected to outpace national growth with cargo volumes increasing from 317.20 MMT to 720 MMT over the same period, at a CAGR of 17.50%. The state’s minor ports are strategically positioned to handle specialized cargo such as coal and minerals, complementing India’s 7,516.6 km coastline, 12 major ports, and 217 minor ports. Backed by liberalization-led trade expansion, strong port infrastructure, and a strategic location in global shipping routes, India’s logistics sector spanning transportation, warehousing, and supply chain solutions remains a critical enabler of economic growth and a beneficiary of rising global supply chain integration.

| Particulars | Details |

|---|---|

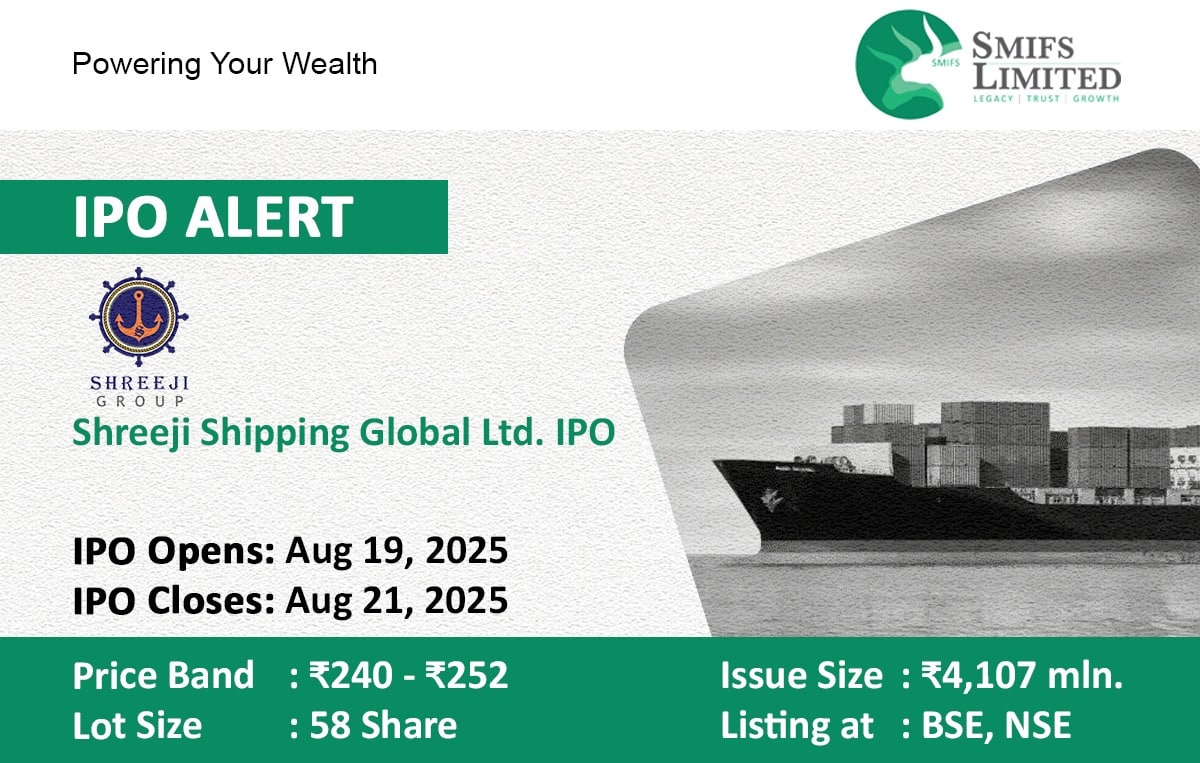

| IPO Open Date | August 19, 2025 |

| IPO Close Date | August 21, 2025 |

| Price Band | ₹240 to ₹252 per share |

| Lot Size | 58 Shares |

| Issue Size | ₹4,107 mln |

| Listing At | BSE, NSE |

| Tentative Listing Date | [To be announced] |

Shreeji Shipping is a seasoned provider of integrated shipping and logistics solutions for dry bulk cargo, operating across various ports and jetties in India and Sri Lanka. As of March 31, 2025, the company commands a fleet of over 80 vessels including barges, mini bulk carriers, tug boats, and floating cranes, alongside more than 370 earthmoving and material handling equipment, enabling end-to-end service delivery. With a legacy spanning over three decades, Shreeji Shipping has built deep expertise in cargo handling, transportation, fleet chartering, equipment rental, and ancillary services. Its cargo handling operations encompass ship-to-ship (STS) lighterage, stevedoring, and comprehensive port services, while its logistics arm offers efficient transportation solutions for dry bulk cargo, from port-to-premise and premise-to-port, catering to the diverse needs of its clients.

In FY25, Shreeji Shipping recorded revenue from operations of ₹6,076.13 million, supported by steady cargo volumes and service demand. The company reported robust profitability, with PAT rising to ₹1,412.37 million, reflecting a healthy PAT margin of 23.24% and an EBITDA margin expanding to 33.03% on EBITDA of ₹2,006.82 million. Strong returns were maintained, with ROE at 42.91% and ROCE at 28.09%, underscoring efficient capital deployment. Operationally, the company handled 15.71 MMT of cargo and transported 2.49 MMT, serving 106 customers across India and Sri Lanka. Supported by a diversified fleet and efficient asset utilization, the business continues to demonstrate strong cash generation, with net operating cash flows of ₹1,387.89 million and a comfortable debt service coverage ratio of 15.49x, positioning it well for future growth.

Objects of the issue:

- Acquisition of Vessels – INR 2511.79 million

- Prepayment and Repayment of borrowings – INR 230 million

- General Corporate Purposes

📱 Apply Online through the SMIFS ELITE App | Download now:

Experience seamless investing at your fingertips!