The Indian mangalsutra market, valued at ₹178 billion in FY23, grew 16% y-o-y and is expected to expand to ₹192 billion in FY24, reflecting sustained demand driven by cultural traditions and rising wedding expenditures. Over the longer term, the market is projected to grow at a CAGR of 5.8% to reach ₹303 billion by FY32. As a symbol of marriage, mangalsutras hold deep cultural significance, with gold remaining the preferred material owing to its association with wealth, purity, and auspiciousness. Regional variations in design across India create a wide and diverse market, while evolving consumer preferences for customization and personalization are further supporting premiumisation and long term industry growth.

| Detail | Information |

|---|---|

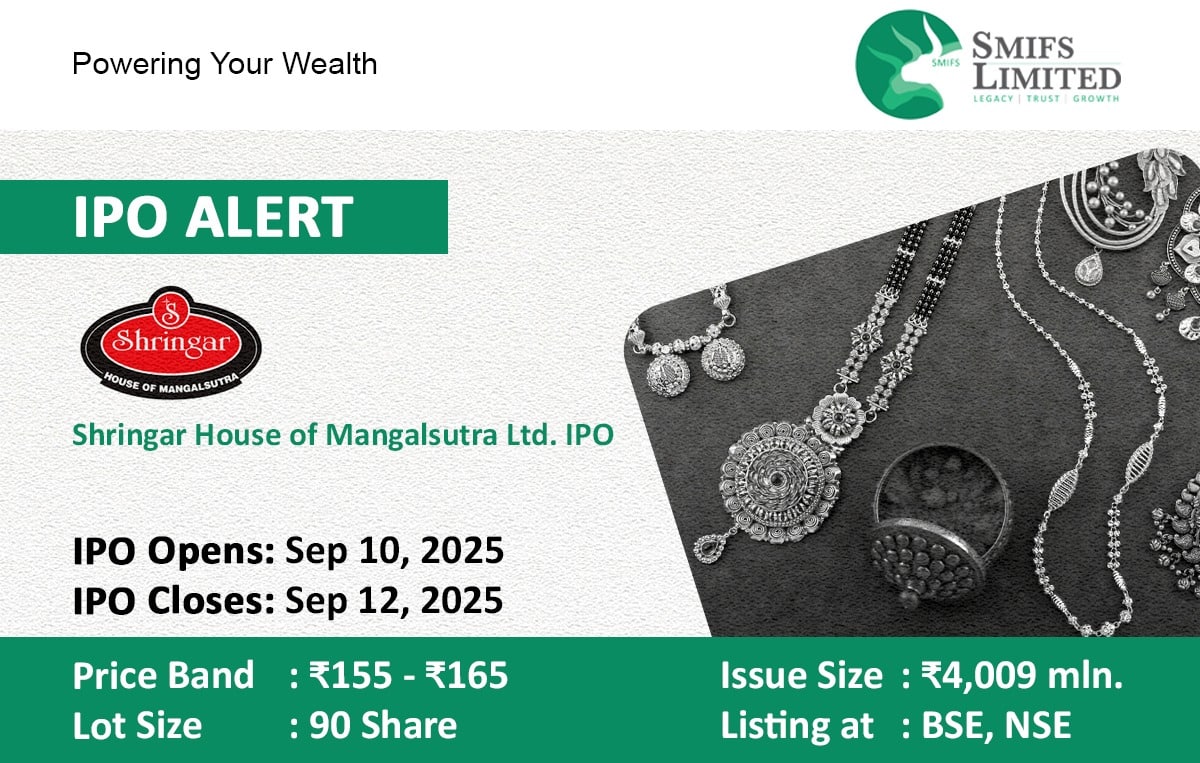

| IPO Open Date | Sep 10, 2025 |

| IPO Close Date | Sep 12, 2025 |

| Price Band | ₹155 – ₹165 per share |

| Lot Size | 90 shares |

| Issue Size | ₹4,009 million |

| Listing At | BSE, NSE |

| Tentative Listing Date | To be announced |

Shringar House of Mangalsutra is amongst the leading and specialized designers and manufacturers of mangalsutras in India, with a contribution of 6% to the organized market in FY23. The company is engaged in designing, manufacturing, and marketing a diverse range of mangalsutras crafted in 18k and 22k gold, often studded with American diamonds, cubic zirconia, pearls, mother of pearl, and other semi-precious stones, catering primarily to B2B clients. With strong expertise in blending traditional significance with contemporary designs, the company has established a niche presence in a culturally rooted yet evolving segment of the Indian jewellery market.

Shringar House of Mangalsutra has delivered robust financial performance with consistent growth across key metrics. Revenue from operations grew from ₹9,502.17 million in FY23 to ₹14,298.15 million in FY25, reflecting a healthy CAGR of 22.67%. Profitability improved significantly, with EBITDA more than doubling over the period to ₹926.12 million in FY25, translating into an enhanced margin of 6.48% versus 4.09% in FY23. Net profit after tax more than doubled to ₹611.14 million in FY25, with margins strengthening to 4.27%. Return ratios have shown marked improvement, with ROE rising to 36.20% and ROCE to 32.43% in FY25, underscoring efficient capital deployment. The company has also maintained a comfortable capital structure with debt-equity declining to 0.61, while working capital days remain at manageable levels. Overall, the financial trajectory highlights strong growth, improving profitability, and prudent balance sheet management.

Objects of the Issue:

- Funding Working Capital requirements – INR 2800 million

- General corporate purposes

📱 Apply Online through the SMIFS ELITE App | Download now:

Experience seamless investing at your fingertips!