Signature Global Ltd. is the largest real estate development company in the National Capital Region of Delhi (DelhiNCR) in the affordable and lower mid-segment housing in terms of units supplied (below INR 8 million price category) between 2020 and the three months ended March 31, 2023, with a market share of 19%. The company commenced operations in 2014 through its subsidiary, Signature Builders Private Limited, with the launch of its Solera project on 6.13 acres of land in Gurugram, Haryana. Signature has grown its operations over the years and in less than a decade, and as of March 31, 2023, the company sold 27,965 residential and commercial units, all within the Delhi NCR region, with an aggregate saleable area of 18.90 million square ft. As of March 31, 2023, Signature sold 25,089 residential units with an average selling price of INR 3.60 million per unit. Signature has strategically focused on the Affordable Housing (AH) segment (below INR 4 million price category) and the Middle Income Housing (MH) segment (between INR 4 million to INR 2.5 million private category) through GoI and state government policies. As of March 31, 2023, Signature completed an aggregate developable area of 7.64 million square feet in its completed projects and an additional 1.37million square feet in its ongoing projects, comprising 11,427residential units and 932commercial units, for which the company has received occupation certificates.

Investment Rationale:

Growing potential of affordable housing in Gurugram, Delhi NCR:

- With a population of more than 46 million and spread over 53,000 square kms, Delhi NCR has witnessed urbanization levels of around 62%.

- Delhi NCR is also the country’s largest planned region. There are growing need about the provision of adequate and up-to-date urban infrastructure and basic amenities, with NCR’s urbanization rate being almost double of the national level. Various national initiatives such as PMAY, Housing for All by 2022, AMRUT, Smart Cities Mission and Infrastructure status to Affordable Housing have been taken to address the pressing urban housing shortage. Regional authorities such as Delhi Development Authority (DDA), Haryana Urban Development Authority (HUDA) and Ghaziabad Development Authority (GDA) are also actively participating to ensure that affordable housing is provided to the target segment of the population.

- Going forward, new affordable developments are likely to be observed on the outskirts due to increasing land and construction cost. This provides a growth opportunity for Signature.

Continued focus on affordable and lower mid-segment housing:

- Affordable and lower mid segment housing constituted the largest segment in terms of supply between FY17 and the three months ended March 31, 2023, in the top seven cities in India, indicating significant preference for this category in the Indian housing market. Favourable state government policies such as the AHP and DDJAY -APHP in Haryana and better access to finance have led to affordable housing growth. Around 119,923 units were launched in the affordable and mid-segment (in the below INR 8 million price category) in Delhi NCR during the period between FY17 and the three months ended March 31, 2023. Gurugram and Sohna collectively were the key contributors and accounted for 68% of the overall affordable supply in Delhi NCR in FY23.

- Given the trends from previous years, it is expected that the affordable housing segment will have continued traction in the market with respect to supply due to sustainable demand. A similar trend is likely to be observed, given the large demand from end-users. We believe this unmet demand for affordable housing provides Signature with an opportunity to grow its market share. As of March 31, 2023, Signature has a portfolio of 29 ongoing projects and 19 forthcoming projects aggregating to 38.50 million square ft. Signature intends to utilize affordable housing policies in Delhi NCR and focus on projects having residential units with ticket sizes ranging from INR 4 million to INR 25 million, based on changing customer preferences.

Positive operating cash flows with low levels of debt:

- Signatureglobal’s asset turnover ratio was 1.54, 2.77and 1.92 in FY21, FY22 and FY23, respectively. Signatureglobal has been able to generate positive operating cash flows despite incurring significant business development expenses for growth and without significantly increasing leverage.

- In FY21, FY22 and FY23, Signature’s operating surplus before land advance or acquisition, which reflects the surplus post-construction expenses, selling, general and administrative expenses and taxes adjusted from collections, were INR 2,488.56 million, INR 4,701.43 million and INR 6,912.15million, respectively.

Valuation and Views:

Signatureglobal is looking to benefit from:

i. Increasing urbanisation in Gurugram it will drive demand for affordable housing.

ii. Signature’s strategy to utilize affordable housing policies in Delhi NCR and focus on projects having residential units with ticket sizes ranging from INR 4 million to INR 25 million, based on changing customer preferences.

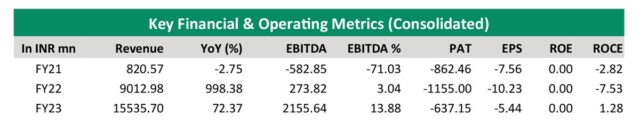

iii. Improving debt to equity ratio. The company reported revenues of INR 15,535.70 million which represented a CAGR of 335.12% between FY21-FY23. The company’s sales in terms of area was 4.35 million units which represented a CAGR of 1.17% in FY23. Signatureglobal reported adjusted EBITDA of INR 2155.64 million in FY23 compared with INR 273.82 million and INR (582.85 million) in FY22 and FY21 respectively. The company’s net debt increased at a CAGR of 40.10% to INR 10,938.92 million in FY23. The company’s losses have been decreasing rapidly as the company’s net loss dropped to INR 637.15 million from INR 1155 million in FY22 and INR 86246 million in FY21. While still loss making and negative cash flows on account of high inventory, we expect the company to clock in healthy growth over the next -5 years given strong demand vicinity in the affordable segment. We recommend to subscribe to the issue as long term investment as the growth rates should be robust and the improvement in EBIDTA numbers is also promising, with medium risk as the company is yet to report profits or positive cashflows.

You can read about Signatureglobal India IPO Note.