In today’s technologically integrated society, the flow of information is free and fast providing many opportunities along the way. However, caution should be exercised when coming across financial offers or plans in the digital domain as instant rich and other such tempting schemes can lead to a hasty decision coupled with a lapse of judgment.

|

QUICK NOTES

|

Investment scams and schemes designed to dupe Investors come in many forms, from Ponzi schemes and Pyramid schemes to fraudulent websites designed to phish your details. In all of the cases, the Investor becomes a victim due to a lack of knowledge on how to recognize a red flag or the warning signs before it is too late.

Therefore, it is important to follow a path of educating oneself on a continual basis as the Financial Market is a dynamic and ever-changing environment. Investor education is not a one-time event; it is a continuous process to stay informed and knowledgeable about the Financial markets and their investments to better protect yourself and make informed financial decisions.

Types of Investment Fraud

The Digital Revolution in India has brought a lot of positives to the country in the form of seamless integration and cashless payments, however, money transfer fraud has been on the rise due to the increased inter-connectivity across devices. Common methods include an individual or a group of individuals posing as a trustworthy or legal entity in order to trick unsuspecting Investors.

Some of the Most Common Fraudulent Schemes

-

Investment Scams:

A common type of money transfer fraud involving an individual receiving investment offers with high returns via email or a phone call. They are then asked to transfer the investment amount to the scammer’s account in order to proceed.

-

Phishing Scams:

These types of scams rely on unsuspecting or unaware individuals clicking on fraudulent links that appear to be from a legitimate source (such as a bank or government) asking for their bank account or credit card details.

-

Invoice Fraud:

Targeted fraud on businesses and individuals involved in frequent transfers of money abroad. The scam’s premise is fake invoices or payment requests to try and trick the victim into a fund transfer to the scammer’s account.

-

Social Media Scams:

The popularity of WhatsApp and Facebook in India has given rise to scams on social media. The scam involves someone posing as a friend or a family member asking for a money transfer due to an unforeseen financial emergency.

-

Identity Theft:

Identity Theft is when a fraudster acquires the personal or financial details of another person and uses them to conduct transactions and authorisations on behalf of the victim. Particulars that are critical to a person involve a bank account, credit card, Aadhaar, PAN and any other document or credential that can be used to pose and digitally authorise as you.

In the era of innovative technologies and modern devices, cyberspace has erased geographical boundaries, enabling the exchange of information and global interaction. However, this interconnected and seamless connectivity presents challenges, as cybercriminals continually devise new methods to defraud individuals who often lack the awareness or knowledge to know any better.

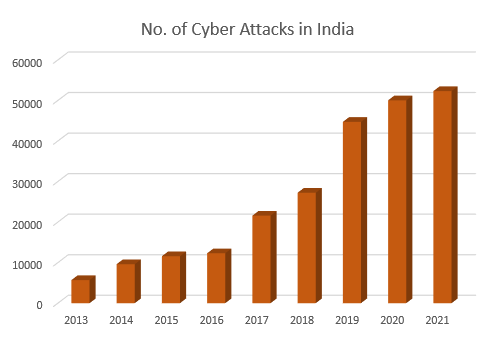

The National Crime Records Bureau (NCRB), reported that in the three years of 2019, 2020, and 2021, the number of cases registered across the country was 44,735, 50,035, and 52,974, respectively. As per the information reported to and tracked by the Indian Computer Emergency Response Team (CERT-In, Electronics and IT Ministry), 11,58,208, 14,02,809, and 13,91,457 numbers of cyber security incidents like phishing, malicious mobile applications, and ransomware were observed and handled by it in 2020, 2021, and 2022 respectively. As can be seen, there has been an enormous growth in cybercrime and the number of Investors getting duped out of their hard-earned money through dubious schemes and methods.

Avoid conducting online financial transactions without the knowledge of how to verify their legitimacy or authenticity. With the growing trend of scams and schemes becoming more complex and sophisticated through the usage of new-age tools, it is always better to consult a Registered Investment Advisor (SEBI Registered) to gauge the opportunity and legitimacy of schemes and plans offered through digital media and not fall prey to investments offering high returns with little to no risk involved.

Major Trends in Cyber-Fraud

Amidst the growing number of fraudulent methods and activities used to dupe Investors, three major trends can be observed over the past three years:

- Cryptocurrency

Illegally obtained crypto is often used for money laundering. The most common premise is that an Investor gets provided with a digital wallet to deposit their funds and watch it grow and turn a profit. However, the funds cannot be withdrawn without paying a never-ending loop of commissions and taxes, ultimately leading to the account being frozen and a financial loss to the Investor.

- Money Mule

Premised upon convincing a potential victim to receive money into their bank accounts by assuring a lucrative commission. They are then directed to transfer the funds into another account as per the fraudster’s directions, thus starting a chain and knowingly or unknowingly laundering money for the scammer. In these cases, the first point of police investigation and the burden of providing evidence falls on the mule (victim).

- Instant Loan or Fast and Easy Loan Apps

Phishing website or app disguised as a legitimate lending company. Designed to plant malware on the user’s device once they click the link to download every file (gallery, contacts, SMS, etc.) of the victim’s phone to gain access to private and confidential information. This information is then used to threaten and harass the individual to extort money out of them.

Smart Practices to Safeguard Your Investments

- Exercise increased caution when talking to or receiving offers or advice from a stranger

Investment Opportunities and prospects are usually communicated or promoted through official or public channels and not a private SMS or WhatsApp message. Any advice volunteered without an invitation should be treated with scepticism and caution to perceive it as a deception.

- Research Thoroughly

The company, the individuals and the scheme should be well-researched, investigated and cross-checked to another point of reference whether it be reviews, ratings or some other metric. It is better to take more time and be slower on the move compared to being hasty and taking a big financial hit.

- Never Share Personal Information

Digital Personal Information is crucial for a lot of documents and IDs. Losing such information can lead to identity theft and/or internet banking fraud. Always be careful about what website or app you’re entering your personal or financial details into, and make sure to verify it has https:// instead of http:// along with the lock symbol and the Verisign.

- If in Doubt, Seek Professional Financial Help

Advice from licensed Financial Advisors or Professionals can help you distinguish between a legitimate investment opportunity and a fraud. Along with the distinction, they can also provide guidance and strategies based on your financial goals and risk tolerance.

- Use Official and Verified Channels

Steer clear of making purchases or disclosing personal information on Social Media. Instead, whenever applicable, use secure and official communication channels provided by the Financial Institutions, Advisors, or Brokers.

- If it Sounds Too Good to be True, It Probably is

Investment Opportunities presenting themselves as low to no risk with assured high returns are more often than not scams. Investments are inherently risky and as such, the notion of a guaranteed super high return without any risk is dubious at best.

- Understand the Basics of an Investment

Fundamental investment concepts and their workings such as Diversification, Risk-tolerance, and Asset Allocation should be learned as research is the best defence against unsolicited investment offers.

- Exercise Scepticism

If an opportunity to invest seems too good to be true, it most often is. High-pressure sales techniques and unsolicited investment pitches should raise suspicions immediately.

Be Aware of Scam Types: Fraud involving investments change with time. To prevent becoming a victim, stay informed on new scams and their methods.

- Regularly Update Passwords

It is important to change your ATM and net banking passwords on a regular basis, along with it being a strong one where one cannot easily guess the credentials based on common factors such as your birthday, name, last name, etc. Equally as important, however, is that the passwords across multiple accounts and purposes should not be the same to mitigate the risk in case one of them gets compromised.

Summary

To protect yourself from unsolicited investment offers, it’s crucial to exercise caution and conduct thorough research before making any financial decisions. Scepticism of high returns with little to no risk, verifying the legitimacy of investment opportunities and consulting with Registered Investment Advisors are all smart and beneficial practices to safeguard yourself from unsolicited investment offers. In tandem with the above, it is also important for an Investor to stay informed and vigilant about the current scams and the tactics being used to avoid falling victim to such schemes in the first place.