India’s consumer electronics market, valued at US$71.7 billion in FY25, is projected to grow at a CAGR of 12.4% to reach US$128.6 billion by FY30, supported by rising disposable incomes, urbanization, digital connectivity, and government initiatives such as Digital India and Make in India. Alongside this, the secondary electronics market, comprising refurbished and used products has seen rapid growth, reaching US$19.8 billion in FY25 and expected to grow at a CAGR of 15.6% to US$40.7 billion by FY30. Refurbished products, unlike used ones sold ‘as-is’, undergo extensive testing and repairs to meet OEM standards and often include warranties, offering consumers affordable and reliable alternatives to new electronics. Increased cost sensitivity, growing environmental awareness, and support for a circular economy have driven demand for refurbished smartphones, laptops, and PCs which together account for around 35% of the secondary market in FY25 and are expected to remain key growth drivers going forward.

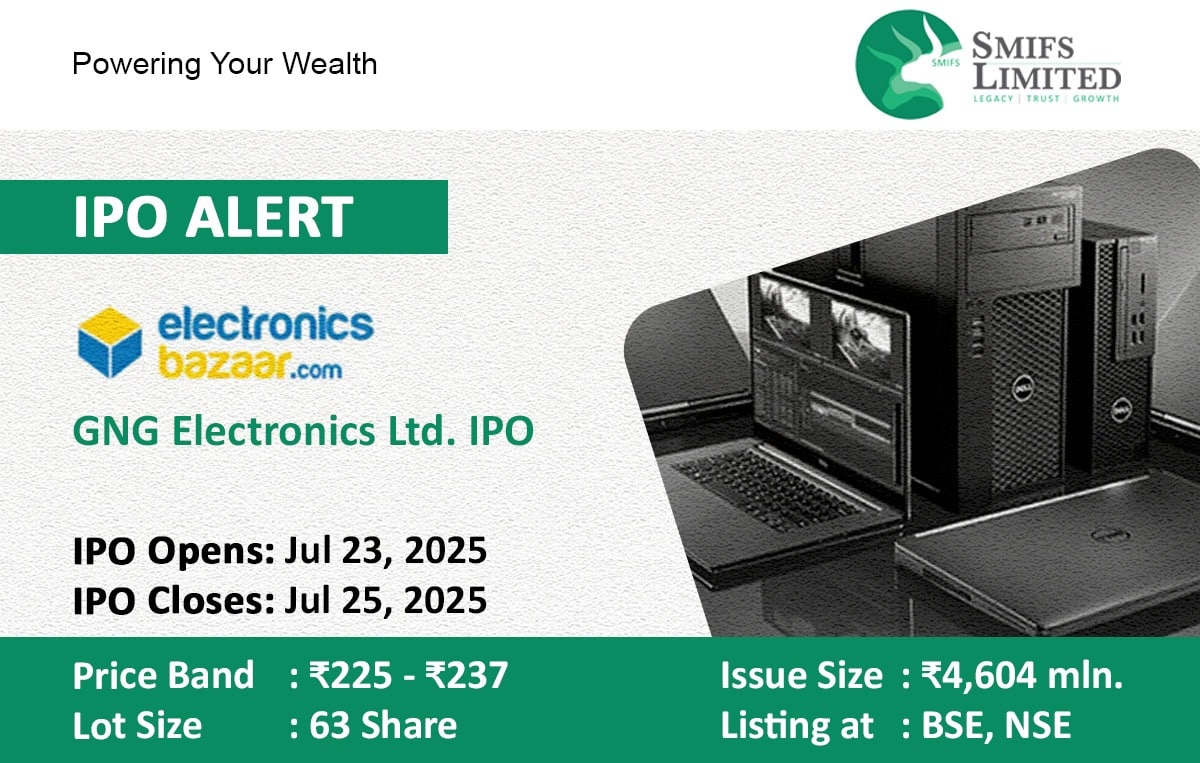

| Particulars | Details |

|---|---|

| Open Date | July 23, 2025 |

| IPO Close Date | July 25, 2025 |

| Price Band | ₹225 to ₹237 per share |

| Lot Size | 63 Shares |

| Issue Size | ₹460.43 Cr (Total Issue) |

| Listing At | BSE, NSE |

| Tentative Listing Date | [To be announced] |

GNG Electronics, operating under the brand “Electronics Bazaar,” is India’s largest refurbisher of laptops and desktops and ranks among the largest refurbishers of ICT devices globally and domestically by value. With a strong presence across India, the USA, Europe, Africa, and the UAE, the company operates across the full refurbishment value chain from sourcing and refurbishment to sales, after sale services, and warranty support. GNG addresses the growing demand for affordable, reliable, and premium ICT devices that match new products in both functionality and aesthetics, while offering customers the added assurance of proven warranty coverage. In addition to its core refurbishment business, the company also offers customized solutions, IT asset disposition, e-waste management, doorstep services, flexible payment plans, upgrade options, and buyback programs for refurbished devices, enhancing its value proposition and deepening customer engagement across segments.

GNG Electronics has demonstrated a stellar financial performance marked by sharp growth across key metrics. Total equity nearly doubled from ₹1,118.26 million in FY23 to ₹2,271.29 million in FY25, reflecting strong value creation for shareholders. Revenue from operations surged over FY23-25, growing from ₹6,595.42 million to ₹14,111.10 million, driven by scale, market expansion, and increasing demand for refurbished ICT products. Operating profitability improved significantly, with EBITDA expanding from ₹500.40 million in FY23 to ₹1,261.44 million in FY25, reflecting the company’s growing scale and improved operating performance. Net profit also saw robust growth, rising from ₹324.28 million to ₹690.33 million during the same period. This translated into a jump in diluted EPS from ₹3.33 to ₹7.09, reinforcing strong earnings visibility. Complementing its earnings momentum, GNG delivered strong return ratios in FY25, with ROE at 30.40% and ROCE at 17.31%, highlighting efficient capital allocation and reinforcing confidence in the company’s long term growth strategy.

Objects of the issue:

- Prepayment and Repayment of borrowings – INR 3200 million

- General corporate purposes

📱 Apply Online through the SMIFS ELITE App | Download now:

Experience seamless investing at your fingertips!