The Indian jewellery market is poised for robust expansion, with the overall market expected to grow by 13.1% YoY in FY24 to ₹4,653 billion, and further projected to expand at a healthy CAGR of 9.7% between FY23 and FY29 to reach ₹7,162 billion. While the gems and jewellery industry witnessed a subdued performance in the first half of FY24, demand is anticipated to rebound in the second half, supported by festive and wedding related purchases. Looking ahead, a sustained recovery is expected, driven by moderating inflation, easing geopolitical tensions, and steady expansion by organized jewellery retailers across India. This growth trajectory is underpinned by rising disposable incomes among the middle class, who increasingly view gold jewellery as both a symbol of status and a reliable investment.

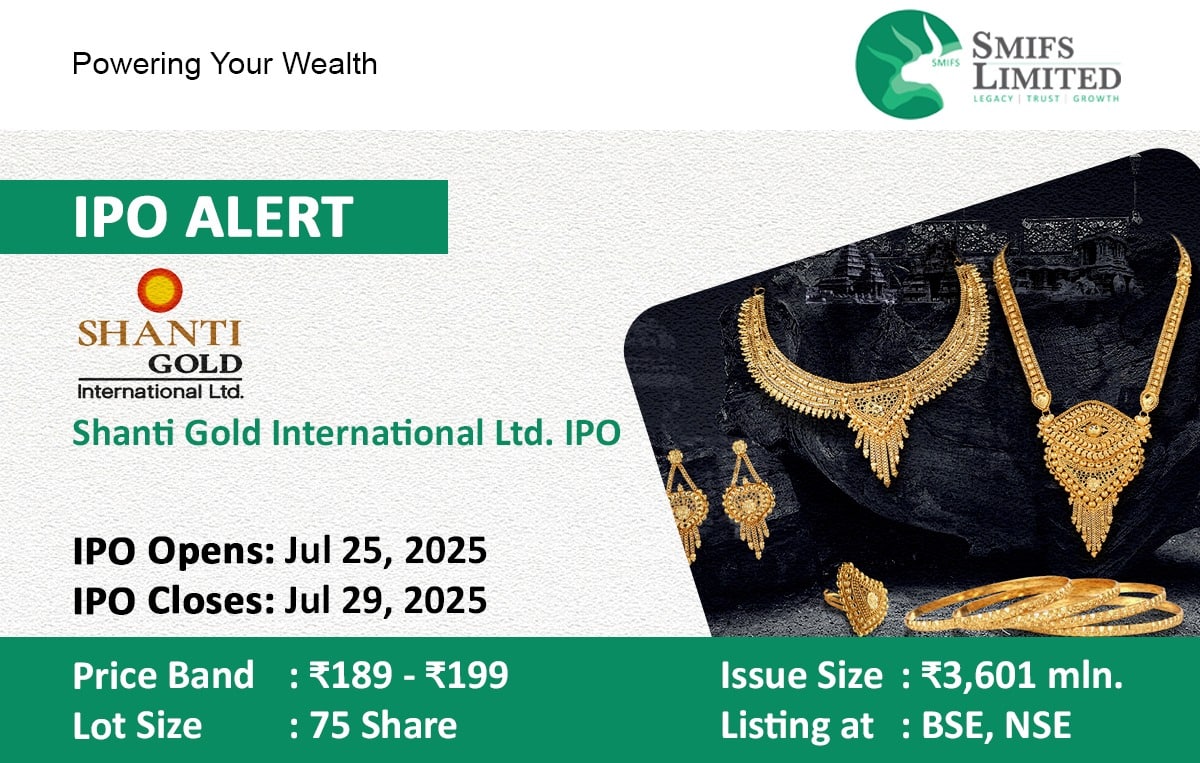

Incorporated in 2003, Shanti Gold International Limited is engaged in the manufacturing of high-quality 22kt cubic zirconia (CZ) casting gold jewellery, with a strong focus on design excellence and craftsmanship. The company offers a diverse product portfolio comprising intricately designed bangles, rings, necklaces, and complete sets catering to a broad customer base across wedding, festive, special occasion, and daily wear segments. As of May 31, 2025, Shanti Gold has expanded its footprint across 15 states and one union territory, with presence in key metro cities such as Mumbai, Bangalore, Chennai, and Hyderabad. Backed by an in-house manufacturing facility spanning 13,448.86 sq. ft. in Andheri East, Mumbai, with an installed capacity of 2,700 kg per annum, the company ensures end-to-end control over design, production, and packaging. A combination of advanced machinery and skilled outsourced labour for precision tasks like manual stone setting reinforces its commitment to quality and craftsmanship.

Shanti Gold International has delivered a strong financial performance, with revenue from operations rising from ₹6,794.04 million in FY23 to ₹11,064.07 million in FY25, reflecting consistent business momentum. EBITDA more than doubled to ₹977.14 million during this period, with margins expanding from 6.71% to 8.83%, indicating improved operating leverage. Net profit almost tripled to ₹558.42 million, with PAT margins improving to 5.05%. Return on Equity and (ROE) and Return on Capital Employed (ROCE) strengthened significantly to 44.85% and 25.70% in FY25 respectively, highlighting efficient capital deployment. The debt-to-equity ratio also improved from 2.37 in FY23 to 1.60 in FY25, reflecting better balance sheet strength and disciplined leverage management. These trends reflect the company’s growing scale, operational efficiency, and sound financial management.

Objects of the issue:

- Funding Working Capital requirements – INR 2000 million

- Capital expenditure for proposed Jaipur facility – INR 462.97 million

- Prepayment and / or repayment of borrowings – INR 170 million

- General corporate purposes

📱 Apply Online through the SMIFS ELITE App | Download now:

Experience seamless investing at your fingertips!