Happy Forgings Ltd. is the fourth largest engineering-led manufacturer of complex and safety-critical, heavy-forged, and high-precision machined components in India as of Fiscal 2023 in terms of forgings capacity. The company, through its vertically integrated operations, is engaged in engineering, process design, testing, manufacturing, and supply of a variety of components that are both margin-accretive and value-additive. It primarily caters to domestic and global original equipment manufacturers (OEMs) manufacturing commercial vehicles in the automotive sector, while in the non-automotive sector, it caters to manufacturers of farm equipment, off-highway vehicles, and industrial equipment and machinery for oil and gas, power generation, railways, and wind turbine industries. The company’s current forging capacity is 107,000 MTPA, and its machining capacity of 46,000 MTPA. The company has India’s second-largest production capacity for high-powered industrial crankshafts. It makes crankshafts of 10-210 kg that are used in diverse application fields. Sales to commercial-vehicle customers account for 43% of revenue, followed by farm equipment (37%), and off-highway (16%), with the balance coming from industries. Customers include Ashok Leyland, VE Commercial Vehicles, Dana India, JCB India, and Mahindra & Mahindra. It exports to nine countries, including Sweden, Turkey, and Italy.

Investment Rationale:

Increasing share of machined components business in revenues is boosting margins.

- The share of machined parts—a segment that enjoys higher realisation in forging—in the company’s total volume has been consistently increasing, and it has been able to source raw materials at a lower rate. This helped Happy Forgings enjoy the highest operating margin among its peers.

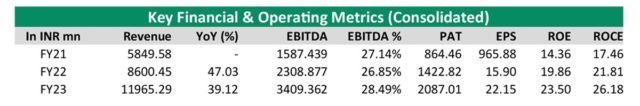

- As of FY23, Happy Forging is only the second company in India to have a 14,000-tonne forging press or higher and is among four companies in India that possess an 8,000-tonne forging press or higher. The company has consistently delivered EBITDA margins in the range of 27–28% over FY21–23.

- We expect improvement in margins by another 200–300 bp over the coming quarters, led by a cost-increasing share of machined parts revenue and optimisation due to lower steel prices.

Expanding capacity at existing manufacturing facilities:

- Happy Forging operates three manufacturing facilities, with two located at Kanganwal in Ludhiana, Punjab, and one at Dugri in Ludhiana, Punjab. While one of the manufacturing facilities at Kanganwal is dedicated to forging operations, the other two are equipped with both forging and machining capabilities.

- The company proposes to purchase new machinery and equipment to build up additional capacity for forging and machining operations from the Net Offer Proceeds. Happy Forging is in the process of commissioning a new 6,300-tonne forging press line, expected to be installed by June 2024.

- The company has also previously strategically increased capacity without compromising on return ratio, although 33% of its gross value of fixed assets was a result of capex incurred between FY22 and FY23.

- There is ample room for export growth; exports accounted for 20% of revenue in the first half of FY24, and that was significantly lower than its peers. The company offers an attractive value proposition for overseas customers by offering 15-20% lower prices than the current landed cost.

Long-standing relationships with customers across industries:

- Through over 40 years of business operations, the company has established long-standing relationships with several Indian and global customers across industries.

- It is among the few companies in India that manufacture and supply high-precision safety-critical components to leading OEMs, including manufacturers of commercial vehicles, farm equipment, off-highway vehicles, and industrial equipment and machinery for the oil and gas, power generation, railways, and wind turbine industries.

- It has a diversified customer base, and it served 66 customers in fiscal 2023 and 59 customers in the six months ended September 30, 2023.

Valuation and outlook: We are positive about Happy Forging due to: i. The company has better margins with lower valuations when compared with its peers. ii. The share of machined parts has been consistently increasing in the company’s total volume, a segment that enjoys higher realisation in forging. It has also been able to source raw materials at a lower rate. This helped Happy Forgings enjoy the highest operating margin among its peers. The forging and machining capacities of the company are currently 107,000 MTPA and 46,000 MTPA, respectively. The range of the tonnage press is between 2,500 and 14,000 T. A 6,300 T press line is expected by FY24, while another 10,000T press is expected by FY25. iv. Barriers to entry into their business are very high due to heavy weight, closed tolerance, and stringent quality requirements of OEMs. v. Happy Forgings has 66 large clients, and 70% of its revenue is contributed by the top 10 clients with whom the company has a relationship of 14–21 years. The company’s total income increased by 38.81% YoY to INR 12,022.71 million in FY23. The company’s PAT for FY22 was INR 1,422.89 million, compared to INR 2,087.01 million in FY23. We recommend a subscription to the issue as the capex undertaken and to be undertaken has the potential to double the earnings of the company as the utilisation ramps up to optimum levels coupled with interest savings on debt repayments. At the upper end of the price band, the company is demanding a P/E multiple of 38x on the trailing 12-month earnings, which is in line with or below the valuations of comparable peers.